Small Business

Who Must Register a Foreign Business in California and How to Comply Legally

Who Needs to Register Foreign Business in California?

Any out-of-state business—corporations, LLCs, or general partnerships—that plans to conduct repeated and consecutive business activities within California must register as a foreign entity with the state.

General Registration Requirements

California requires businesses formed outside the state to register before conducting business there. This registration applies if the business engages in intrastate commerce, meaning repeated and consecutive transactions within California, excluding activities related solely to foreign or interstate commerce.

- Foreign corporations must file a Statement and Designation by Foreign Corporation.

- Foreign LLCs must file an Application to Register.

- General partnerships must submit a Statement of Partnership Authority (Form GP–1).

Registration ensures legal compliance and allows the entity to transact business officially within California boundaries.

Understanding “Doing Business” in California

California’s Franchise Tax Board (FTB) defines “doing business” as actively engaging in transactions for financial gain within the state, being organized or domiciled in California, or exceeding specific thresholds related to sales, payroll, or property.

| Criteria | Description |

|---|---|

| Sales | Annual California sales exceeding $637,252 |

| Property | Holding real or tangible property over $637,252 in California |

| Payroll | Paying compensation above $637,252 to California-based employees |

Exceeding these metrics triggers an obligation to file tax returns and usually register as a foreign business.

Types of Entities Required to Register

Different entities face distinct filing requirements:

- Foreign Corporations: File Statement and Designation by Foreign Corporation with a home state Certificate of Good Standing; filing fee $100 (2023).

- Foreign LLCs: File Application to Register along with Certificate of Good Standing; filing fee $70 (2023).

- General Partnerships: Submit Statement of Partnership Authority (Form GP–1).

The name of the business, registered agent information in California, and proof of good standing from the formation state are necessary for filing.

When Registration Is Not Required

Certain activities within California do not count as “doing business” and thus do not require registration:

- Defending or settling lawsuits.

- Holding internal company meetings.

- Maintaining a bank account.

- Soliciting orders that require acceptance outside California.

- Conducting isolated transactions completed within 180 days.

- Transacting business in interstate or foreign commerce exclusively.

Also, mere ownership by a foreign business in California-based subsidiaries or limited partnership or LLC membership does not mandate registration.

Filing Process and Documentation

To register, businesses must submit detailed information:

- Official business name registered in the home state; an alternate name if used in California.

- State of formation.

- Statement confirming the business’s good standing in its home state.

- Name and street address of the California registered agent.

- Principal office addresses (both general and California, if any).

- Authorized signature from an officer or member.

A Certificate of Good Standing issued by the home state is mandatory for submission.

Consequences of Not Registering

Failing to register when required opens the business to multiple penalties:

- Daily fines for unauthorized business activity.

- Misdemeanor fines.

- An inability to initiate lawsuits in California courts.

LLCs without registration cannot file lawsuits but retain the ability to defend legal actions. Members or managers are not personally liable for obligations arising solely from unregistered activity.

Maintaining Compliance After Registration

Registered foreign businesses must maintain compliance similar to California-incorporated entities. This includes:

- Timely filing of tax returns.

- Payment of applicable state business taxes.

- Ongoing adherence to California Secretary of State filing requirements.

Consultation with legal counsel is strongly advised to navigate the nuances of California’s business laws accurately.

Key Takeaways

- Out-of-state businesses conducting repeated sales or transactions in California must register as foreign entities.

- Registration obligations arise with significant in-state sales, property, or payroll thresholds.

- Foreign corporations, LLCs, and partnerships each have specific forms and fees to file.

- Certain isolated or passive activities do not require registration.

- Failure to register risks fines and loss of lawsuits rights within California.

- Ongoing compliance after registration is mandatory, including tax filing and fee payments.

- Legal consultation is recommended to ensure full compliance.

Who Needs to Register Foreign Business in California? The Straight Talk Every Out‑of‑State Entrepreneur Needs

So, you’ve got a business that’s not from California, but you’re eyeing that Golden State market. Maybe you’re thinking, “Do I really have to wade through the paperwork and register my company here?” Short answer: Yes, if your out-of-state business is actively doing or planning to do business within California, you’re required to register as a foreign business. No shortcuts. Now, buckle up. Let’s unpack who exactly falls under this rule, what counts as doing business, and why skipping registration isn’t just ill-advised—it’s downright risky.

The Fine Print on When That Foreign Business Hat Comes Into Play

Imagine your business as a traveler from another state arriving in California. In the business world, if you’re operating here regularly or engaging in repeated transactions that make money within California, the state expects you to formally check in. This process is called “foreign qualification” or registering your foreign business. And it applies whether you run a corporation, a limited liability company (LLC), or even a general partnership.

California’s Corporate Code is pretty clear: any company formed *outside* California that “enters into repeated and consecutive transactions” here—unless those activities strictly involve interstate commerce (think shipping goods across state lines)—must register. This ensures that California can keep track of businesses benefiting from its economy and tax the activities accordingly (Cal. Corp. Code § 191; Cal. Corp. Code § 17708.03, 2023).

Hold on! What exactly counts as “doing business”? The Franchise Tax Board (FTB) looks for certain signs:

- Engaging in any transaction within California aimed at financial gain.

- Being organized or having your main commercial headquarters in California.

- Having sales, property, or payroll surpassing specific thresholds in the state.

If you tick any of these boxes, it’s time to start the registration dance.

Not All Footprints Mean You’re Stamping ‘Resident’ — Activities That Don’t Trigger Registration

Now, before you break into a sweat, there’s good news: California also carves out exceptions. Just because you have some presence or activity doesn’t mean you must register. The Revised Uniform LLC Act and General Corporation Law list several activities that don’t count as transacting business requiring registration:

- Defending or settling lawsuits—because hey, legal issues happen everywhere.

- Managing internal affairs—holding those all-important board meetings or shareholder calls.

- Maintaining a bank account or handling company securities through appointed agencies.

- Selling through independent contractors instead of company employees.

- Obtaining orders physically outside California that get accepted only after they leave the state.

- Completing isolated transactions promptly—if it’s a one-off within 180 days and not a pattern.

And, just so you know, being a shareholder or partner of a California entity doesn’t automatically mean your parent company needs to register. No need to panic about holding a stake; it’s your direct business operations inside California that matter most (Cal. Corp. Code § 191, 17708.03).

Filing Your Registration: How to Get Your Foreign Business Legally Qualified

When your business activity crosses into the “doing business” zone, the state requires you to file proper paperwork with the California Secretary of State. The type of form and fee depends on your entity:

| Entity Type | Form to File | 2023 Filing Fee | Additional Requirement |

|---|---|---|---|

| Foreign Corporation | Statement and Designation by Foreign Corporation | $100 | Certificate of Good Standing from home state |

| Foreign LLC | Application to Register | $70 | Certificate of Good Standing from home state |

| General Partnership | Statement of Partnership Authority (Form GP–1) | Varies | Certificate of Good Standing, if applicable |

You can file these forms online or mail them via traditional post. The forms ask for details like your business’s original registered name, any alternate name you plan to use in California, your home state, and addresses for your principal office and your registered agent in California. Don’t forget the Certificate of Good Standing, typically issued within six months by your home state’s Secretary of State or equivalent agency.

What If You Ghost California and Don’t Register? Spoiler: Not Ideal

Choosing to ignore registration isn’t just playing a game of ‘hide and seek’ with the government—it comes with some not-so-fun consequences:

- Daily fines pile up like unread emails.

- Your business could be hit with misdemeanor penalties—that’s legal trouble you don’t want to drag around.

- Your company cannot file a lawsuit in California courts until it sorts out its registration. Yes, that means no suing to enforce contracts or defend your rights in a dispute (Cal. Corp. Code § 2203).

- LLCs dodging registration can still defend themselves in lawsuits, but they lose other rights like initiating legal action.

Luckily, members or managers of your LLC won’t personally owe for the LLC’s debts just because you forgot this step. Still, it’s like forgetting to pay your rent—the landlord won’t be thrilled (Cal. Corp. Code § 17708.07, 2023).

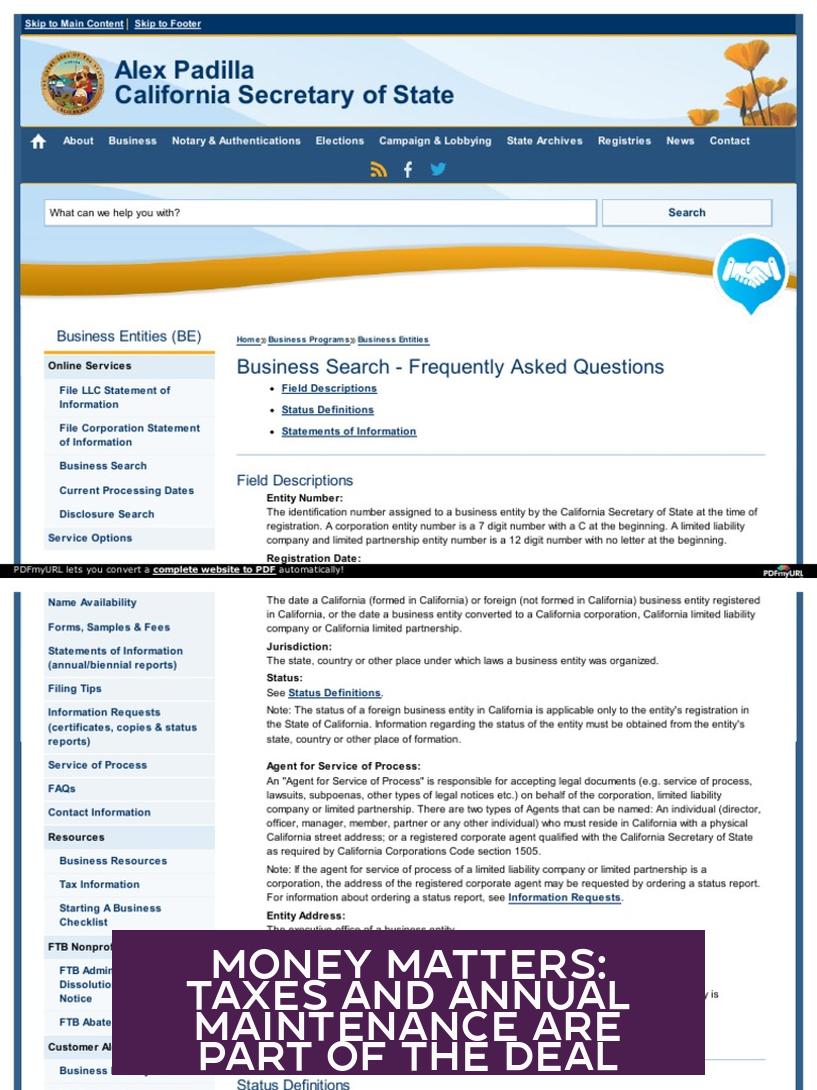

Money Matters: Taxes and Annual Maintenance Are Part of the Deal

Registration is just the beginning. You must keep your foreign business active by complying with California’s tax and reporting obligations. The Franchise Tax Board monitors who owes what, when. If your business crosses the thresholds of sales or property values (think big bucks—over about $637,000), you’re definitely on their radar for tax filings (Revenue and Taxation Code § 23101).

Remember, the FTB’s definition of doing business might differ slightly from the Secretary of State’s. That’s why your best friend in this convoluted journey is a savvy California business attorney who can help you untangle legalese and federal/state differences.

Have You Checked the FAQs and Guidance from the Secretary of State?

Navigating foreign business registration gets easier if you leverage the resources the California Secretary of State offers. They provide a frequently asked questions page that rolls up common concerns, submission requirements, and directs you to the pertinent laws if you want to double-check for yourself.

Additionally, if you operate an LLC, it’s wise to look into California’s annual report and tax filing requirements to ensure you don’t miss deadlines, incur penalties, or—worse yet—fall out of good standing.

Is Your Business Really Required to Register? That Legal Advice Is Golden

Activity thresholds, varying interpretations of “doing business,” and exceptions mean that no two businesses are exactly alike when it comes to California’s foreign registration requirements.

Feel confused? You’re not alone. Even experienced entrepreneurs sometimes struggle with these rules. A California-licensed business attorney can provide tailored guidance based on your company’s unique facts, helping you decide whether your activities necessitate registration and how to stay compliant without unnecessary headaches.

Wrapping It Up: Who Should Register a Foreign Business in California?

Let’s recap the essentials with zero fluff:

- If your business started outside California but plans regular, repeated transactions or activities in California aimed at financial gain, you must register as a foreign entity.

- Foreign corporations and LLCs have specific forms and filing fees to complete to gain legal footing in California.

- If your company surpasses sales, property, or payroll thresholds, California taxes and reporting obligations kick in.

- Certain activities like isolated transactions or internal affairs don’t trigger registration requirements.

- Failing to register means fines, inability to sue in California courts, and legal complications.

- Professional legal help is strongly recommended to navigate uncertainties.

So, next time you dream of expanding your business to California’s sunny shores, remember: register first, or face the (financial and legal) heat. It’s the smart, responsible move to grow your brand in this vibrant market.

Got your business checklist ready? Make foreign qualification part of the first steps on your Californian adventure—and keep your company golden in the Golden State.

Who needs to register a foreign business in California?

Any out-of-state corporation, LLC, or general partnership planning to conduct business or engage in repeated transactions within California must register as a foreign entity.

What types of activities require a foreign business to register in California?

Repeated intrastate transactions, sales, property ownership, or payroll above certain thresholds mean the business is “doing business” and must register.

Are there any exemptions where a foreign business does not need to register?

Yes. Activities like holding meetings, maintaining a bank account, soliciting orders accepted out-of-state, or isolated one-time transactions under 180 days don’t require registration.

What forms must foreign corporations and LLCs file to register in California?

Foreign corporations file a Statement and Designation by Foreign Corporation; foreign LLCs file an Application to Register. Both require a Certificate of Good Standing from their home state.

Does having a subsidiary in California mean the parent foreign business must register?

No. A foreign business does not need to register just because its subsidiary operates in California, unless the parent itself engages in transactions in the state.

Small Business

Vitamin Business Opportunity: Market Growth, Models, and Profit Strategies

Exploring the Vitamin Business Opportunity

The vitamin business opportunity lies in a rapidly growing global market with high demand, flexible regulatory requirements, and multiple viable business models. Entrepreneurs can capitalize on market expansion, diverse product lines, and evolving consumer needs. This industry offers several profitable avenues backed by solid growth trends and consumer health awareness.

Market Growth and Demand Dynamics

The global dietary supplement market reached a size of $167.5 billion in 2023. Experts predict a steady compound annual growth rate exceeding 7%, potentially pushing the market near $240 billion by 2028. This surge springs primarily from dietary gaps and immune health concerns. Many consumers turn to vitamins to offset nutritional deficiencies and improve wellness.

- Unhealthy diets drive persistent demand for supplements.

- Vitamins appeal to a wide demographic aiming to enhance immunity.

This expansive market creates fertile ground for newcomers and established brands alike.

Regulatory Landscape Advantages

The Dietary Supplement Health and Education Act (DSHEA) of 1994 significantly eased entry barriers by not requiring FDA approval for vitamin products. Instead, the FDA focuses on removing unsafe or illegal supplements after reaching the market. Entrepreneurs benefit from reduced regulatory hurdles but must remain vigilant about compliance to maintain credibility and safety.

| Aspect | Detail |

|---|---|

| FDA Approval | Not mandatory before sales |

| FDA’s Role | Identifies and removes unsafe/illegal products |

| Recommended | Stay updated on supplement laws |

Vitamin Business Ideas and Models

Launching a Private Vitamin Brand

Vitamins do not require FDA approval before sale, easing brand launch processes. Entrepreneurs can develop lines focusing on quality and organic ingredients to align with current trends. Starting with low-demand products reduces competition and can unlock untapped niches.

- Options include gummy vitamins, vitamin-infused drinks, and other innovative formats.

- White-label services simplify brand establishment by providing ready-made formulations.

Subscription Box Business

Regular supplement intake by consumers supports subscription box models that deliver monthly vitamins. Customization based on individual health needs enhances retention. Offering additional services like physician consultations strengthens customer trust.

- Wholesale pricing benefits improve margins.

- Add complementary products like skincare and medical supplies.

Pet Vitamin Products

The pet supplement segment focuses on animal health needs. Livestock and dairy farm operators often purchase supplements in bulk. Animal feed producers incorporate protein powders and vitamins as ingredients.

Supplements Retail Store

Entrepreneurs can operate online or physical specialty stores focusing on dietary supplements. In-person stores provide improved customer service and expert advice. Online dropshipping offers low startup cost and operational flexibility.

- Additional sales include protein snacks, workout gear, and gym apparel.

Steps to Pursue a Vitamin Business Opportunity

- Research: Study the niche, competitors, and compliance requirements. Consult legal experts.

- Planning: Develop a business plan incorporating goals, finances, risk management, and marketing.

- Partnerships: Secure reliable distributors and explore collaborations with gyms or health professionals.

- Marketing: Target audiences via social media, bundle offerings, and distinctive packaging.

- Adaptation: Use customer feedback to refine products and respond to market trends.

Profitability and Industry Potential

Vitamin businesses enjoy profit margins typically ranging from 30% to 50%. The large base of supplement users—about 75% of U.S. adults have taken supplements by 2020—sustains strong demand. The global market’s size and growth potential are compelling incentives for investment.

Main Product Categories

- Multivitamins

- Standalone vitamins

- Probiotics

- Mineral supplements

- Fatty acids

Wholesale Buying and Platform Support

Purchasing vitamins wholesale allows sellers to earn a retail margin. Platforms like BlueCart help connect suppliers with thousands of potential buyers. Automation tools on such platforms streamline order management and improve operational efficiency.

Key Takeaways

- The vitamin market is growing fast and forecasted to reach nearly $240 billion by 2028.

- FDA approval is not required for vitamin sales but regulatory compliance remains critical.

- Business models include private brands, subscription boxes, pet supplements, and retail stores.

- Profit margins typically range from 30% to 50%, with high consumer demand sustaining sales.

- Thorough research, solid planning, partnerships, and adaptable marketing drive success.

- Wholesale buying and digital platforms facilitate supply chain optimization and sales growth.

Unlocking the Vitamin Business Opportunity: Your Guide to a Thriving Supplement Venture

Is jumping into the vitamin business a smart move today? Absolutely. The dietary supplement market is booming, creating multiple doors for entrepreneurs ready to seize the opportunity.

Let’s dive into why this industry shines, what you need to know before you get started, and how you can craft a venture that’s both profitable and sustainable.

Why the Vitamin Business Market Is Buzzing

The vitamin and dietary supplement landscape has transformed dramatically over recent decades. Driven by a worldwide surge in wellness awareness, it’s a goldmine of possibilities. The global market clocked in at a staggering $167.5 billion in 2023 and is forecasted to climb toward $240 billion by 2028, maintaining an impressive growth rate above 7% annually.

Why such high demand? It boils down to people’s health habits. Many consume unbalanced diets or battle weakened immune systems, relying on supplements to fill nutritional gaps. This persistent need keeps the market humming, ensuring steady consumer interest and repeat business.

Navigating the Regulatory Maze

Thinking of launching your vitamin line? Good news: you don’t need FDA approval before selling dietary supplements. The passage of the Dietary Supplement Health and Education Act (DSHEA) in 1994 paved the way for a proliferation of supplement products, significantly loosening regulatory hurdles.

That said, there’s no free pass. The FDA retains authority to remove products deemed unsafe or falsely advertised. So, compliance with labeling and safety regulations remains essential. Hiring a legal expert to steer you through the specifics isn’t just a suggestion—it’s smart business.

Creative Business Models to Consider

The vitamin business isn’t a one-size-fits-all arena. There’s a buffet of options depending on your passion, capital, and market insight.

- Starting Your Own Brand: With no FDA pre-approval required, launching a brand is accessible. Focus on quality and organic ingredients to capture trend-conscious consumers. Starting with lower-demand products can reduce competition and boost your chances. Innovative twists, like gummy vitamins or vitamin-infused beverages, can differentiate your offerings. White-label options simplify brand creation by letting you rebrand existing products.

- Subscription Boxes: Supplements thrive on regular usage. Offering a subscription service taps into this, delivering customized vitamins right to consumers’ doors. Adding perks like free consultations with physicians adds value, making customers stick around. Plus, buying wholesale allows for attractive margins. Throwing in medical supplies or skincare items can widen appeal and increase revenue streams.

- Pet Vitamins: Don’t forget our furry friends! The animal supplement market is sizable and growing. Businesses in animal husbandry or dairy farming look for wholesale supplement supplies to boost livestock health. Similarly, animal feed manufacturers integrate supplements like protein powders into their products. Pet vitamins offer a unique angle in this space.

- Supplement Stores: Whether online or physical, specialty stores cater to customers seeking personalized advice and immediate purchases. Brick-and-mortar outlets shine with their customer service edge. Online stores can leverage dropshipping for lower startup costs and greater flexibility. Selling complementary products such as protein bars, workout gear, and gym apparel can enhance profits.

Five Phases to Launch Your Vitamin Business Successfully

Before you pour cash into bottles and labels, follow these phases for a well-rounded start.

- Research: Comprehensive niche and competitor analysis is your foundation. You also need a thorough understanding of all legal regulations. Hiring a professional lawyer knowledgeable in dietary supplement law is often worth the investment.

- Planning: A detailed business plan guides you. Outline your goals, financial forecasts, marketing strategy, and potential risks. Consider a risk management plan to navigate inevitable bumps.

- Partnerships: Secure reliable distributors early. Collaborate with related businesses like gyms or fitness coaches who can help push your product through consignment deals. Early B2B sales can fund your next steps.

- Marketing: Marketing isn’t just helpful—it’s crucial. Pinpoint your audience, leverage social media, and design eye-catching packaging that complies with the law. Offer bundle deals and discounts to attract customers initially and keep them coming back.

- Adapt and Improve: The market never stands still. Constantly adjust to changing consumer needs and new trends. Customer feedback is your treasure trove for product improvement and customer satisfaction.

What Makes Vitamin Businesses Profitable?

The economics of this industry are enticing. Typical profit margins hover between 30% and 50%. Combine this with broad market demand—statistics show around 75% of U.S. adults tried dietary supplements at least once in 2020—and you’ve got powerful market potential. An expanding audience and high repeat purchase behavior create a rock-solid business foundation.

Core Products to Include in Your Portfolio

Knowing what to sell helps streamline your efforts. The big five product categories generally include:

- Multivitamins

- Standalone vitamins (like Vitamin D or C)

- Probiotics

- Mineral supplements

- Fatty acids (Omega-3, for example)

Hitting these categories covers a wide spectrum of consumer needs and preferences.

Boosting Your Vitamin Venture with Wholesale and Technology

Buying wholesale improves your cost efficiency, allowing you to sell at retail prices competitively. Platforms like BlueCart simplify the supply chain by connecting you with thousands of suppliers and customers. Their tools also automate repetitive tasks, helping you focus on growth rather than admin headaches.

Final Thoughts: Is the Vitamin Business Opportunity Right for You?

With wellness booming and consumers hungry for supplements, it’s an exciting time to jump in. That said, success hinges on smart research, legal savvy, strong partnerships, and savvy marketing. The opportunities stretch from niche organic brands to subscription models, pet supplements, and beyond.

So, is it time to invest your entrepreneurial energy into vitamins? If you’re ready for a blend of health passion, business grit, and customer focus, the market is wide open—and waiting.

What’s your next step?

What makes the vitamin business a growing opportunity?

The dietary supplement market is expanding rapidly. With over $167 billion in sales in 2023 and projected growth of 7% annually, demand for vitamins continues to rise globally.

Can I start a vitamin brand without FDA approval?

Yes, dietary supplements do not require FDA approval before selling. However, the FDA can remove unsafe products. Compliance with other regulations is necessary.

What are some viable vitamin business models?

- Launching a private label brand focusing on quality ingredients.

- Subscription box services offering customized supplements.

- Pet vitamin products for animal health markets.

- Supplements retail stores online or physical locations.

How critical is market research before starting a vitamin business?

Thorough research is essential. Understanding competitors, the target market, and legal regulations helps reduce risks and positions your business better.

What marketing strategies work best for vitamin businesses?

Social media marketing targeting health-conscious consumers is key. Partnering with gyms, fitness trainers, or influencers can boost brand visibility and sales.

Small Business

How Search Engine Marketing Enables Marketers to Display Ads on Websites

How Marketing Lets Marketers Place Ads on Websites with Search Engines

Marketing lets marketers place ads on websites with search engines through Search Engine Marketing (SEM), a paid digital advertising method that helps businesses appear prominently on search engine results pages (SERPs). SEM drives visibility by bidding on relevant keywords and displaying ads when users enter search queries tied to those words. This method uses a pay-per-click (PPC) model where marketers pay only when a user clicks an ad.

Understanding Search Engine Marketing (SEM)

SEM is the process of boosting a brand or product’s visibility in search engines like Google, Bing, or Yahoo through paid ads. It focuses on placing ads in response to user search queries, giving businesses a chance to reach potential customers actively searching for products or services they provide.

- Advertisers bid on keywords related to their offering.

- Ads appear alongside organic search results, typically at the top or bottom.

- SEM strictly involves paid ads, distinguishing it from search engine optimization (SEO), which targets unpaid, organic search rankings.

How SEM Works — The Mechanics

Advertisers enter an ad auction on the search engine platform. Google Ads, for example, evaluates ads based on two main factors: bid amount and Quality Score. Quality Score measures an ad’s relevance to the targeted keyword and overall user experience on the landing page.

Ad placement depends on:

- Keyword Relevance: Ads match the user’s search terms to ensure alignment.

- Bid Value: The amount an advertiser is willing to pay per click influences ad rank.

- Quality Score: Higher scores reduce cost-per-click (CPC) and improve ad position.

Advertisers can target audiences intricately by location, device type, and time of day or week, making SEM flexible and precise.

The Role of SEM in Marketing Strategies

SEM helps businesses show ads to users when they have high intent to purchase. This intent-driven method is beneficial for:

- Small, medium, and large businesses.

- Immediate exposure to potential customers.

- Driving website traffic and increasing leads or sales.

Using SEM, marketers place ads that appear on search engine results pages and other websites affiliated with the search engine’s advertising network, connecting products and services directly with interested users.

Benefits of Using SEM for Advertisement

- Targeted Reach: Ads appear to users based on keywords, geography, device, and time.

- Pay-Per-Click Model: Advertisers pay only when a user clicks an ad, optimizing the ad spend.

- Real-Time Adjustments: Campaigns can be modified or paused instantly based on performance data.

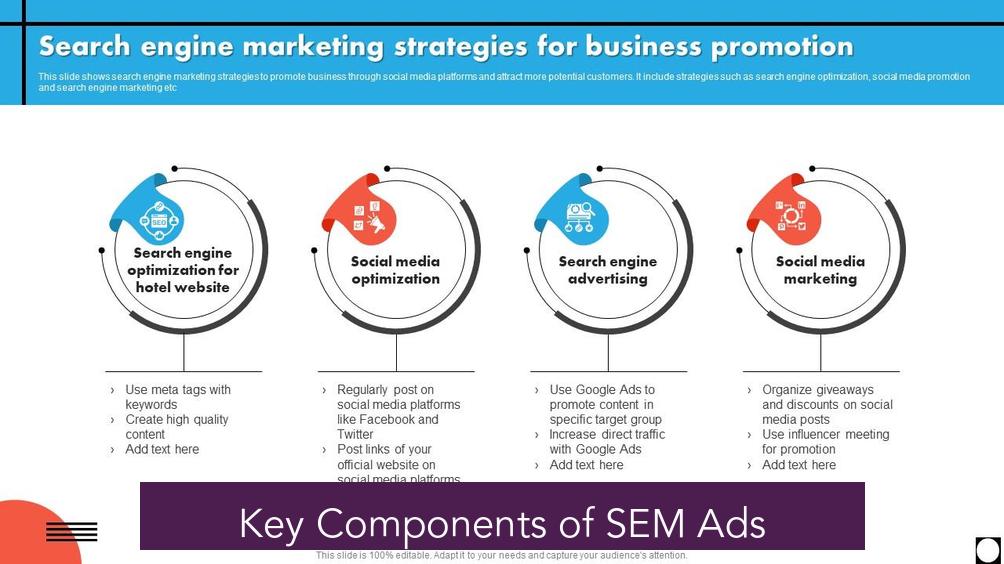

Key Components of SEM Ads

| Component | Description |

|---|---|

| Headline | The clickable blue text users see on search results |

| Description | Short text below the headline providing details |

| Extensions | Additional links or call-to-action buttons |

| Landing Page | The web page users are directed to after clicking the ad |

Proper keyword research is critical for SEM success. Tools such as Semrush, Google Ads Keyword Planner, and Google Trends help marketers identify valuable keywords and analyze competition and trends.

SEM Platforms and Comparison with SEO

- Platforms: Google Ads is the leading platform, with Microsoft Advertising and Yahoo! Native as alternatives.

- SEM vs. SEO: SEM buys ad placements for immediate traffic, while SEO is a longer-term strategy to improve organic rankings without direct payment for placements.

Costs and Budgeting for SEM

SEM budgets vary widely based on goals and industries. Small campaigns might cost around $500 monthly, while larger efforts exceed $10,000. The cost per click ranges from $2 to over $55 depending on keyword competition and industry.

Marketers can adjust spending throughout campaigns to optimize ROI. High competition keywords require higher bids to appear on the first page of search results.

Key Takeaways

- SEM allows businesses to place pay-per-click ads on search engine results and associated websites.

- Advertisers bid on keywords, with ad rank influenced by bid and Quality Score.

- Targeting options include location, device, and time, increasing ad precision.

- SEM provides measurable, flexible campaigns that can be adjusted in real time.

- Cost varies by industry and keyword competitiveness, with budgets ranging from hundreds to thousands monthly.

How Marketing Lets Marketers Place Ads on Websites with Search Engines

Marketing that lets marketers place ads on websites with search engines is known as Search Engine Marketing (SEM). It involves placing paid advertisements on search engines like Google or Bing to help businesses get in front of potential customers when they are actively searching. SEM makes sure ads show up where and when users are looking for products or services, driving traffic and sales in a highly targeted and cost-efficient way.

Now, let’s unravel the nuts and bolts of this fascinating world where ads meet search engines—and why it’s vital for any business hoping to thrive online.

What Exactly Is Search Engine Marketing?

Search Engine Marketing, or SEM, is a strategy that uses paid advertising to boost your visibility on search engine results pages (SERPs). Unlike SEO, which focuses on organic ranking through website optimization, SEM buys prime ad real estate through paid placements.

SEM targets specific keywords that people type into search engines. When you bid on these keywords, your ad could appear above or alongside organic results, shining bright like a lighthouse amid the ocean of search results.

Here’s a quick fact: SEM used to cover both organic and paid strategies, but these days, it’s strictly the paid side of things, where you pay every time a user clicks your ad—known as pay-per-click (PPC).

Why Is SEM a Big Deal for Marketers?

Picture this: customers searching for the exact product or service you offer. SEM helps place your ads precisely at that moment. It’s like waving a flag saying, “Hey, I’m right here!” on the busiest street in your target market.

Search engines have become the primary way people discover new stuff online. Without a strong SEM strategy, your business is hiding in plain sight—or worse, invisible. SEM is crucial because it gets your brand noticed with laser-focused targeting and measurable results.

What’s more, you only pay when someone clicks your ad. That means you’re spending your dollars efficiently, reaching people who already have the intent to buy or learn more.

The Perks of Placing Ads via SEM

SEM offers some compelling advantages that make it a go-to marketing technique:

- Intent-Driven Advertising: Because users are actively searching, your ads meet them with high intent. It’s like catching fish right when they’re hungry instead of casting in empty water.

- Speedy Results: Unlike SEO, which takes time to build organic traction, SEM can drive visible traffic almost immediately. Great for startups or new product launches.

- Real-Time Control: You get instant data on ad performance. If a campaign flops, turn it off instantly. No sunk cost syndrome here.

- Precise Targeting: Beyond keywords, you can target by location, device types, time of day, and even seasons. Imagine your ad popping only when your audience is sipping coffee at 9 AM on a Tuesday.

What’s Inside a Search Ad?

Wonder what an actual search ad looks like? It’s simpler than you think but powerful:

- Headline: The clickable blue title that grabs attention.

- Description: A brief text snippet that highlights your offer or message.

- Extensions: Extra links or actions, like phone calls or location info, inviting more engagement.

- Landing Page: Where users land after clicking—make sure this page seals the deal!

The headline hooks them, the description persuades them, and the landing page closes the deal. This is SEM’s magic pipeline working seamlessly.

How Does SEM Work Behind the Scenes?

Amazing as it sounds, placing these ads isn’t random. SEM follows a precise process:

- Keyword Research: Marketers find popular, relevant search terms their potential customers use.

- Bid on Keywords: Advertisers enter ad auctions, offering money for placements tied to those keywords.

- Quality Score: Google evaluates ads based on relevance and usefulness. The better your ad fits the keyword, the higher the score, which means lower costs per click (CPC).

- Ad Placement: Google picks winners for slots based on Quality Score and bid price.

Think of it like an auction but with a twist: you pay for clicks, not just views. Even winning your bid won’t get you the top spot if your ad is off-topic or poorly constructed.

How Much Does SEM Cost?

Curious about the price tag? SEM budgets can vary as widely as your neighbor’s taste in home décor—from a modest $500 up to $10,000+ per month depending on competition.

Some industries have sky-high costs per click—think legal or insurance sectors where CPC can soar past $50! Others enjoy bargain rates around $2.

The secret sauce? Keyword competitiveness. If everyone wants the same search term, prices skyrocket. Sometimes you’ll spend more to outbid competitors just to sit on page one.

Tools of the Trade: Helping Marketers Play the SEM Game

Luckily, marketers aren’t flying blind into the SEM jungle. A handful of savvy tools make lives easier, smarter, and more cost-efficient:

- Semrush: Offers end-to-end SEM management—from keyword digging to competitor spying.

- Google Ads Keyword Planner: Perfect for kicking off campaigns with targeted keyword ideas.

- Google Trends: See how keyword popularity changes over time to time your campaigns wisely.

These tools equip marketers to pick the right keywords, optimize bids, and analyze performance like seasoned pros.

How Does SEM Differ from SEO?

SEO and SEM often get tangled in the same conversation but they’re fundamentally different beasts:

- SEM: Paid ads that appear at the top or bottom of search results.

- SEO: Techniques to organically rank your website in search engine results, without paying for clicks.

SEO takes patience and effort. It’s like planting a tree and enjoying shade years later. SEM is turning on a searchlight instantly—but it costs per use.

So, which is better? Depends on your goals. Many savvy marketers combine both to maximize reach and balance short-term wins with long-term growth.

Is Google Ads the Same as SEM?

Not quite. Google Ads is the most popular platform for running SEM campaigns but SEM itself refers to the overall strategy and practice of paid search advertising.

Think of SEM as the game, and Google Ads as one of the playing fields. Other platforms exist too, like Microsoft Advertising and Yahoo! Native ads.

FAQs About Marketing on Search Engines

- Is Facebook SEM? No, Facebook is a social media marketing platform. SEM is specific to paid ads on search engines.

- Are SEM tools secure? Good question! Top SEM tools prioritize security with updates, intrusion detection, and data encryption.

Bottom Line: SEM Powers Targeted Website Advertising

So there you have it—marketing that lets marketers place ads on websites with search engines, aka SEM, is a cornerstone of modern digital marketing. It connects businesses to customers actively searching for what they need, using a smart, cost-effective paid advertising approach.

With its precise targeting, real-time measurability, and speedy results, SEM levels the playing field for businesses of all sizes who want to get noticed online. Plus, the combination of powerful tools and flexible budgets means marketers can tailor campaigns to squeeze every drop of value from their ad spend.

Whether you’re a start-up itching to get your name out there fast, or a giant ready to dominate search rankings, SEM offers an unbeatable way to place your ads exactly where your customers are looking. Have you tried SEM in your marketing mix yet? What’s holding you back?

What is search engine marketing (SEM) and how does it help place ads on websites?

SEM is paid advertising that boosts your brand’s presence in search engine results. It lets marketers place ads on search engines like Google, showing products or services when users search relevant keywords.

How does SEM use keywords to target potential customers?

SEM targets specific keywords related to your product or service. Ads appear when users search those words, with costs depending on keyword competitiveness and relevance, measured by Quality Score.

What is the pay-per-click model in SEM advertising?

In SEM, advertisers pay only when someone clicks their ad. This pay-per-click (PPC) system helps control costs and ensures budget is spent on actual customer engagement.

Can SEM ads be targeted by location and device?

Yes, advertisers can specify where, when, and on which devices their ads appear. Campaigns can be geo-targeted, device-targeted, or scheduled for specific times to reach the right audience.

How does SEM allow marketers to measure and adjust their ad campaigns?

SEM platforms provide real-time data on clicks and conversions. Marketers can track ad performance and quickly change or pause campaigns to improve results or cut losses.

Small Business

How to Leave a Google Review for a Business: Step-by-Step Instructions

How to Leave a Review on Google for a Business

Leaving a review on Google for a business involves logging into your Google account, searching for the business, selecting the review option, giving a star rating, and writing your experience before submitting it. This process is simple and fast, enabling customers to share honest feedback that benefits both consumers and businesses.

What Are Google Reviews?

Google reviews provide verified customer opinions in one place, consolidating location, hours, phone details, and user feedback. Over 84% of consumers trust online reviews as much as personal suggestions from friends or family. Positive Google reviews can improve a business’s ranking in search results and attract more customers.

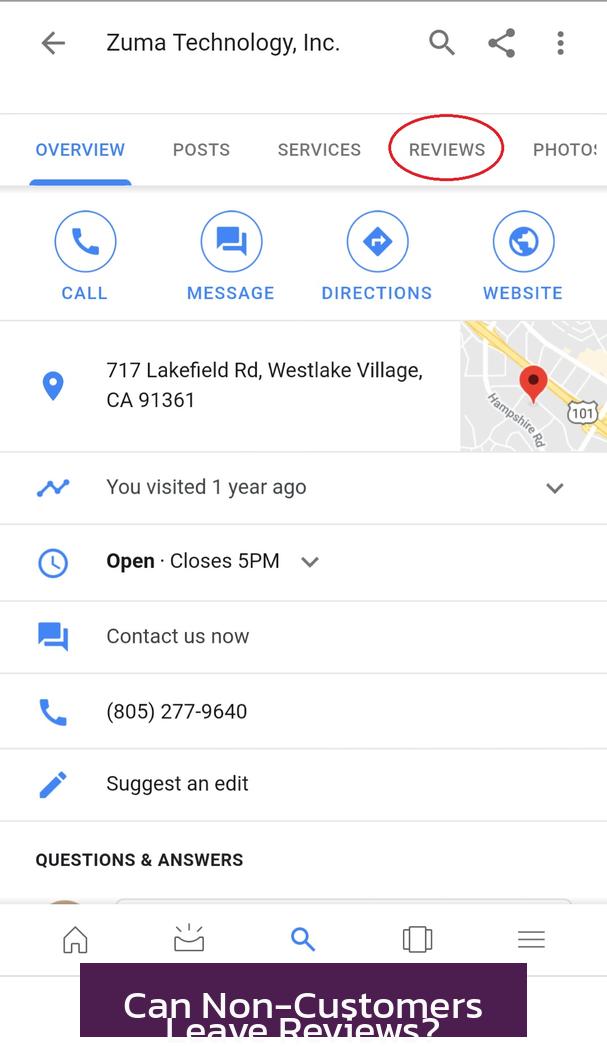

Step-by-Step Guide to Leave a Google Review

- Log in to Your Google Account:

Use the blue login button on the Google homepage’s top right to sign in. Enter your email and password. If you don’t have a Google account, you must create one first. - Find the Business:

Type the company name in the Google search bar or open Google Maps and locate the business. On mobile devices, open the business listing on Google Maps, then tap “Rate & write a report.” - Select “Write a Review”:

On the business profile, you will see existing star ratings and reviews. Click the button labeled “Write a review” to start your own. - Choose a Star Rating:

Rate from 1 star (poor service) to 5 stars (excellent). Each star level reflects your level of satisfaction. - Write Your Review:

Enter your experience or opinion in the text box. Describe your interaction clearly and honestly. - Submit Your Review:

Click “Publish” to post your review publicly on Google.

Important: Reviews written using the same device or network as the business may not display. This restriction helps prevent fake ratings.

Quick Guide Summary

- Log into Google or Google Maps.

- Search for the business.

- Scroll to “Write a Review.”

- Select star rating.

- Write your review.

- Click send or publish.

You’ve now contributed a Google review.

Why Timely Google Reviews Matter

Fast feedback helps businesses adjust quickly to customer needs. Writing a review takes moments unless you choose to write extensively. When customers know how to leave a Google review, businesses can encourage positive feedback effectively.

Additional Insights About Google Reviews

How to Get More Google Reviews

Encourage satisfied customers to write reviews. Ask politely after a good interaction or at purchase points. Incentives are discouraged by Google policies, so focus on genuine requests.

Can Non-Customers Leave Reviews?

Generally, rating a business without using its services is not allowed and may result in removal of the review. For example, you cannot claim a poor haircut if you never visited the salon.

External Experience Reviews by Non-Customers

Non-customers can provide feedback based on indirect interactions, such as phone inquiries or website impressions, as long as the statements are truthful and factual. Examples include commenting on website usability or customer service responsiveness.

Summary: Key Points on Leaving Reviews

- Log into Google account first.

- Search the business on Google or Maps.

- Click “Write a review,” give stars, and write your feedback.

- Publish the review to share it publicly.

- Reviews from non-users based on false claims can be removed.

- Timely direct feedback helps businesses improve.

How to Leave a Review on Google for a Business: A Step-By-Step Guide

Want to share your thoughts about a business on Google but unsure where to start? How to leave a review on Google for a business is straightforward once you learn the steps. Google reviews pack a punch—they combine a business’s info, photos, hours, and feedback all in one place.

With 84% of consumers trusting online reviews as much as personal recommendations, your review can shape someone’s choice. Plus, businesses with positive reviews tend to rank higher on Google Search, getting them more customers (and more reasons for you to write those five stars!). Wondering how to make your review count and actually publish it? Let’s dive in.

Logging In: Your First Step to the Review Stage

First off, you need to be signed into your Google account. Don’t have one? No worries, it’s free and quick to set up. Just click the blue “Login” button in the top right corner of Google’s homepage, enter your email and password (or create a new account), and voila—you’re in.

Think of this as your virtual passport to the land of reviews. Google needs you logged in to ensure your feedback is legit and uniquely tied to a real person. This helps reduce fake reviews, although sometimes it can block genuine ones if, say, the business and reviewer share the same network or device.

Finding the Business You Wish to Review

Once logged in, fire up the search bar. Type the exact name of the business, restaurant, or attraction you want to review. Want to feel a bit more like a detective? Use Google Maps or the Google+ platform (yes, it’s still around in some fashion for reviews).

On a mobile device? Tap the service provider on Google Maps, then hit the button labeled “Rate & write a report.” It’s like knocking on their digital door and being invited inside to share your opinion.

Spotting the Right Spot: Writing Your Review

After searching, you’ll see the business’s profile pop up. Browse existing ratings and comments first for perspective. Found the right place? Click the “Write a review” button.

Here’s where the magic happens. The rating system has two parts:

- Stars: Click on 1 to 5 stars—1 means “not-so-great” and 5 means “wow, highly recommend.”

- Text field: Share a few lines or paragraphs about your experience. You’re the storyteller here. Feel free to mention anything from customer service to ambiance or product quality.

Done? Hit “Publish” to share your thoughts with the world (or at least with anyone who Googles the business). Just a heads-up: Reviews may sometimes fail to display if Google suspects a conflict of interest, like reviews written from the same IP network as the business, but that’s to keep things fair and genuine.

The Quick and Dirty Guide to Posting Your Review

- Open your web browser or Google Maps app on your phone.

- Sign in to your Google account.

- Search for the business you want to review.

- Scroll down to find “Write a Review” next to the Reviews and Add Photo buttons.

- Click “Write a Review”.

- Pick your star rating.

- Jot down your experience or opinion.

- Hit send and bask in the glory of having left your mark!

That’s it. No rocket science involved. Have you ever thought it’d be so simple to make a difference in a business’s online reputation?

Why Bother With Reviews? Why Is Quick Feedback So Important?

Leaving a Google review isn’t just about venting or praising—it’s about shaping real-time customer feedback. This info helps businesses improve and helps future customers make informed choices.

Plus, a speedy review after your visit helps keep your feedback fresh and relevant, which businesses love. It’s probably the easiest and fastest part for you as a reviewer; everything else is just celebrating your new Internet fame.

Frequently Asked Questions: Clearing Up Confusions About Google Reviews

How Can Businesses Get More Google Reviews?

It’s often simple: ask! Businesses that politely encourage happy customers to leave reviews usually see an uptick. Understanding what motivates customers to review helps tailor these requests to feel natural and welcome.

Can Non-Customers Leave Reviews?

Strictly speaking, no. Google expects a reviewer to be a genuine customer to prevent fake or misleading feedback. For example, someone can’t review a haircut if they didn’t get a haircut there—that’s fraudulent.

But Wait, Non-Customers Can Still Say Something?

Yes! If you never bought the product or service but interacted with the business, like asking questions or browsing their website, you can share your external experience. Maybe their website was confusing or an email went unanswered. Your comments must be truthful, but this kind of feedback is allowed.

This adds nuance to reviews, reflecting the full picture of the business beyond just transactions.

Final Thoughts: Your Review Matters

Leaving a review on Google for a business is more than just clicking stars and typing. It’s a powerful act that influences future customers and drives businesses to improve. The process is simple, fast, and gives your voice a platform. Next time you have a memorable experience, good or bad, why not take a minute to share it?

Does the idea of influencing a business’s future sound exciting? Have you ever left a review that changed how others thought about a place? Your next review might just be the one that helps a great business shine or nudges another toward better customer care.

How do I start leaving a Google review for a business?

First, log in to your Google account. If you don’t have one, create a new account. Then, search for the business using Google Search or Google Maps. When you find it, click “Write a review” on its profile.

What steps should I follow to submit my review?

- Select the star rating from 1 to 5.

- Write your opinion in the text field.

- Click the “Publish” button to post your review.

Your review will appear on the business’s Google profile after publishing.

Can I leave a review if I am not a customer of the business?

Non-customers cannot post false claims as reviews. However, they can leave factual feedback about external experience, like website usability or customer service, as long as it is true and accurate.

Why might my Google review not be displayed?

If you use the same device or network linked to the business, your review may not show. This helps prevent fake reviews and keeps the rating trustworthy.

How can a business encourage customers to leave Google reviews?

Businesses can ask satisfied customers directly to leave a review. Knowing why customers leave reviews helps improve the chances of getting positive feedback on Google.

-

Career2 years ago

Career2 years agoWhat is the lowest salary for a pharmacist?

-

Career2 years ago

Career2 years agoCustomer success manager career path

-

Career2 years ago

Career2 years agoWhat is the highest paying customer service?

-

Customer Service2 years ago

Customer Service2 years agoWhat is the highest paid customer service job?

-

Career2 years ago

Career2 years agoWhat are 3 important criteria for choosing a career?

-

Customer Service2 years ago

Customer Service2 years agoOnsumer services a good career path

-

Customer Service2 years ago

Customer Service2 years agoConsumer services jobs

-

Career2 years ago

Career2 years agoWhat is the most popular career path?