Business

What is a high base salary in sales?

Making six figures in sales is the dream for many. It’s the promise of financial freedom and the potential to live a life of luxury. But what does it take to get there? What is a high base salary in sales? How rare is a six-figure salary? And what percentage of 30-year-olds make 100k?

These are commonly asked questions, and the answers may surprise you. According to Indeed, pharmaceutical sales representatives make $66,620 a year, with an additional commission of $21,500. This can go well into six figures, but often requires more travel—one study found that representatives who traveled between 50% and 75% of their time earned an average of $197,245.

When you account for base salary, commission, and bonuses, each of the roles included on this list has a total income potential well over the median household income in the United States, which was $63,179 in 2018, the last year with available data. For example, a sales consultant salary in Franklin, Massachusetts, is 11% higher than the national average; a software sales manager salary in Irvine, California, is 6% higher than the national average; and a digital ad trafficker salary in Perris, California, is 19% higher than the national average.

The reality is that making six figures in sales is difficult, especially for younger professionals. It takes hard work, dedication, and a lot of skill. But the potential rewards are worth it. With the right combination of experience, knowledge, and willingness to take risks, anyone can achieve a six-figure salary in sales.

The key is to understand the high base salary in sales, how rare six-figure salaries are, and what percentage of 30-year-olds make 100k. To help you get started, we’ve compiled the latest data on these topics. Keep reading to learn more about what it takes to make six figures in sales.

What is a high base salary in sales?

Sales is a highly rewarding field that can provide a high base salary as well as additional commissions and bonuses. According to Indeed, pharmaceutical sales representatives make an average of $66,620 per year, with an additional commission of $21,500. This can often lead to six-figure incomes, but it typically requires more travel; one study found that representatives who traveled between 50% and 75% of their time earned an average of $197,245.

When you add up base salary, commission, and bonuses, many of the roles included in the sales profession have total income potentials that exceed the median household income in the United States, which was $63,179 in 2018. For example, a sales consultant salary in Franklin, Massachusetts, is 11% higher than the national average; a software sales manager salary in Irvine, California, is 6% higher than the national average; and a digital ad trafficker salary in Perris, California, is 19% higher than the national average.

The salary potential in sales depends on a variety of factors, including job location, industry, experience, and the type of sales position. For instance, sales jobs in the technology industry tend to pay higher than those in other industries, and sales positions in large metropolitan areas tend to pay more than those in smaller cities. Additionally, experienced sales professionals may be able to negotiate higher salaries, commissions, and bonuses than those in entry-level positions.

Sales professionals can also increase their earnings by taking on additional responsibilities and mastering sales techniques. For example, sales professionals who are proficient in cold calling and lead generation are more likely to close deals and earn higher commissions. Additionally, sales professionals who are knowledgeable about the industry can provide valuable insight to their clients, which can lead to increased sales.

In addition to a high base salary, sales professionals may also be eligible for various perks and benefits, such as health insurance, 401(k) plans, and vacation time. Additionally, many companies offer sales-related bonuses, such as performance-based bonuses, as well as incentives for meeting sales goals.

Overall, the potential for a high base salary in sales depends on a variety of factors, including job location, industry, experience, and the type of sales position. Additionally, sales professionals who are proficient in cold calling, lead generation, and have industry knowledge can increase their earnings potential. Finally, many companies offer sales-related bonuses and incentives that can further increase a sales professional’s earning potential.

What is the average age to make six figures?

Six-figure salaries are not just reserved for those at the top of the corporate ladder; it is possible to make six figures at any age. However, the average age to make six figures is typically in the late-30s or early 40s. This is because many people cannot find a job that pays this much money right out of college. It takes time and experience to land a high-paying job.

At what age should you be making six figures? The average person does not start making a six-figure salary until they are in their 30s. While there is no specific average age to make six figures, Americans over 30 are generally more likely to make a six-figure salary due to their experience.

How common is a six-figure salary? Making six figures is not as common as you might think. According to the Bureau of Labor Statistics, only 8.5% of workers make six figures or more. Furthermore, the number of people making six figures decreases with age. For instance, only 4.7% of Americans aged 25 and younger make six figures, while 12.7% of those aged 45 and older make six figures.

What is the average age of six-figure salary earners? The average age of people making six figures is 38. However, this number can vary depending on the person’s occupation. For instance, the average age of a corporate executive making six figures is 47, while the average age of a software engineer making six figures is 33.

How rare is a six-figure salary? While six-figure salaries are not as rare as you might think, they are still relatively uncommon. According to the Bureau of Labor Statistics, only 8.5% of workers make six figures or more. Furthermore, the number of people making six figures decreases with age. For instance, only 4.7% of Americans aged 25 and younger make six figures, while 12.7% of those aged 45 and older make six figures.

Overall, the average age to make six figures is typically in the late-30s or early 40s. However, there are some people who make six figures earlier due to their exceptional success. It is important to remember that making six figures is not an easy feat and that it takes skill, experience, and hard work in order to achieve this goal.

If you are looking to make six figures, start by researching what jobs typically pay six figures. Then, focus on gaining the experience necessary to land one of these jobs. Finally, network and make connections in the industry in order to increase your chances of landing a high-paying job. With hard work and dedication, you too can make six figures.

What is the toughest part in sales?

Sales is a challenging job and it’s no surprise that there are some difficult parts to it. From taking on unhelpful advice to a lack of resources and sales enablement support, salespeople face many obstacles when it comes to being successful. The toughest part of sales isn’t necessarily the same for everyone, but there are a few key elements that can make it a challenge.

Unhelpful Advice – Taking on unhelpful advice from colleagues, superiors, and other professionals in the industry can be a major obstacle for salespeople. This can lead to salespeople forming bad habits that can be difficult to break. It’s important to be able to recognize when advice is not helpful and to take it with a grain of salt.

Improper Training – Having the wrong training can be a major obstacle for salespeople. Learning the wrong methods and techniques can lead to a lack of success and can make it difficult to break out of that cycle. It’s important to get the right training and guidance to ensure that salespeople are able to reach their goals.

Inexperience – For salespeople who are new to the job, the lack of experience can be a major obstacle. It can be difficult to learn the ropes and understand how to best approach selling. It’s important to gain experience and to be willing to learn from mistakes in order to become a successful salesperson.

Lack of Resources – Many sales teams lack the necessary resources to run smoothly. This can make it difficult to succeed in sales because the team isn’t able to take advantage of the tools and resources available to them. It’s important to ensure that sales teams have access to the resources they need in order to be successful.

Sales Enablement Support – Sales enablement support can be a major obstacle for sales teams. Without the right support, it can be difficult for salespeople to reach their goals and to be successful. It’s important to have the right support in place to ensure that salespeople have the tools and resources they need to succeed.

At the end of the day, the toughest part of sales boils down to three key elements: empathy, a genuine desire to help, and persistence. Being successful in sales requires having the right mindset and being willing to put in the work. With the right attitude and the right resources, salespeople can go far.

What percent of 30 year olds make 100k?

It’s not uncommon to hear people talk about the elusive six-figure salary. But when it comes to the actual numbers, what percentage of 30-year-olds make $100,000 or more?

The answer might surprise you. According to the latest data from the Bureau of Labor Statistics (BLS), only 7% of all 30-year-olds make $100,000 or more per year. That number jumps to 15% for 40-year-olds, 16% for 50-year-olds, and peaks at 21% for 66-year-olds.

Put another way, it’s rare for anyone in their 20s to earn over $100,000, but many people who hit that threshold do so by the time they turn 40. Much like those earning $50,000 or more, the percentage of $100,000+ earners stays fairly consistent until retirement, peaking at age 66.

So what does this mean for millennials and other 30-year-olds looking to reach that six-figure salary? It means that you need to plan ahead and invest in yourself. Start by understanding your current financial situation and setting realistic goals for the future.

For example, if you want to make $100,000 at 30, you’ll need to save and invest as much as possible. Consider budgeting for a house or condo, too. This would mean you would spend around $2,300 per month on your house and have a down payment of 5% to 20%.

You should also look into investing in stocks, bonds, and mutual funds, and make sure to diversify your investments. This will help ensure that you’re not putting all your eggs in one basket.

Finally, it’s important to remember that the road to financial success isn’t easy. It takes hard work and dedication to reach a six-figure salary, and it’s not something that happens overnight. But with the right motivation and dedication, you can reach your goal.

So what percent of millennials make over $100,000? A 10th of millennials said they already earn $100,000, compared to 9% of Gen X and 11% of baby boomers – the only income bracket where boomers earn more than millennials.

Reaching a six-figure salary at 30 is an achievable goal, but it takes hard work and dedication. Start by understanding your current financial situation and setting realistic goals for the future. Invest in yourself, budget for a house or condo, and diversify your investments. With the right motivation and dedication, you can reach your goal.

Remember: it’s rare for anyone in their 20s to earn over $100,000, but many people who hit that threshold do so by the time they turn 40. With the right motivation and dedication, you can reach your goal and become one of the 7% of 30-year-olds who make $100,000 or more.

How rare is a six-figure salary?

When it comes to salaries, six figures is a number many aspire to reach, but how rare is it to actually earn that much? According to the latest data available, around 5.4% of the American population makes 6 figures, but most of them earn in the lower range. For example, approximately 15.5% of 6-figure earners in the US make between $100,000 and $149,999.

So, how hard is it to make 6 figures? Unfortunately, it can be quite hard. The average American salary is around $46,000 and, in order to make 6 figures, you need to make more than double that. It’s not impossible, but it does take a lot of hard work, dedication, and luck.

So, is a 6 figure salary considered rich? It depends on who you ask. The range of salaries earning 6 figures is quite extensive because there is a tremendous difference between earning $100,000 and $999,000. Generally, people consider a lower range of 6-figure salaries as “comfortable” and the higher range as “rich”. Here is a rough categorization:

Low range: $100,000 – $400,000.

Mid range: $400,000 – $700,000.

High range: $700,000 – $999,999.

This is just a rough categorization, as there is no specific range guideline. However, it is safe to say that a 6 figure salary is not as rare as it used to be. According to a report by IBISWorld, in 2020, about 30.7% of Americans received a salary of more than $100,000.

However, it is still not easy to make 6 figures. It requires a lot of dedication, hard work, and luck. You also have to be willing to make sacrifices and work long hours. Additionally, you may need to invest in yourself, such as getting an education or learning new skills.

The good news is that 6 figure salaries are becoming more and more common. With the right combination of hard work, dedication, and luck, you could be one of the 30.7% of Americans who make 6 figures.

What percentage of people in America make 100k?

The American dream is often associated with making a million dollars, but the reality is that many Americans are making much less than that. So what percentage of people in the United States make over $100,000? According to the latest data from the US Census Bureau, approximately 33.6% of U.S. households earn $100,000 or more. That means that one in three households are bringing in a six-figure income.

The data also shows that 18% of individual Americans make over $100,000 per year. That number is higher for households, with 34.4% making over $100k per year. That’s significantly higher than the individual numbers, which means that households are more likely to have multiple earners bringing in over $100,000.

When it comes to race, there is a significant disparity between White households and Black households. 37% of White Households make over $100k, compared to only 22% of Black households. This is likely due to systemic racism and the fact that Black Americans are more likely to be in lower-paying jobs.

Breaking down the numbers further, around 15.5% of Americans earned between $100,000 and $149,999. This number jumps to 8.3% when looking at those who earned between $150,000 and $199,999. Finally, approximately 10.3% of the population earned over $200,000.

So, while the American dream may be to hit the million-dollar mark, the reality is that a significant portion of the population is making much less than that. But with 33.6% of U.S. households bringing in over $100,000, it’s clear that there are plenty of people who are doing well financially.

If you’re looking to join that group, there are a few things you can do to increase your chances of success. Firstly, focus on your education and career path. Research shows that those with higher levels of education and specialized skills tend to make more money. Secondly, work hard and strive for excellence in your field. Finally, don’t be afraid to take risks and invest in yourself. With the right combination of dedication and risk-taking, you too can make over $100,000 per year.

So, what percent of America makes over 100k? According to the latest US Census Bureau data, 33.6% of U.S. households earn $100,000 or more. While this number may not seem like much, it’s important to remember that this is still a significant portion of the population. With hard work and dedication, you can join this group and make your own American dream a reality.

Business

What is the highest position in operations?

Are you interested in finding out what the highest position in operations is? If so, you’ve come to the right place. The Chief Operating Officer (COO) is the highest-ranking executive position in an organization, forming part of the “C-suite”. The COO is typically the second-in-command at the firm, especially when the highest-ranking executive is the chairperson and CEO. But what is higher than a VP of operations? What are the four orders of operations? Who is higher, a GM or VP? What are the three levels of operations? And who is above the Director of Operations?

To answer these questions and more, let’s take an in-depth look at the hierarchy of operations jobs and the roles and responsibilities of each position. Starting with the highest position in operations, the COO is responsible for managing the daily operations of the company and ensuring that all departments are working together efficiently. They are also responsible for implementing the company’s long-term goals and strategies.

The second-in-command of operations is the Vice President of Operations. This position is responsible for developing and overseeing operational processes, such as budgeting, scheduling, and resource management. They also ensure that operational goals are met and provide guidance to operational teams. The General Manager is next in the order of operations and is responsible for managing the day-to-day operations of the business, including budgeting, staffing, and customer service.

Below the General Manager are the Directors of Operations, who are responsible for directing and coordinating the activities of the operational teams. Finally, there are the supervisors, who are responsible for overseeing the day-to-day activities of the operational teams. They are also responsible for ensuring that operational goals are met and providing feedback to their teams.

As you can see, there are many different levels of operations, each with their own unique responsibilities. Knowing the hierarchy of operations jobs can help you identify the right role for your skills and experience. It can also help you understand the roles and responsibilities of those in higher positions, such as the COO, VP of Operations, and General Manager. With this information in hand, you’ll be one step closer to finding the perfect job in operations.

What is the highest position in operations?

Operations management is a core function of any business, and the highest level of operations job is the chief operating officer (COO). The COO is typically the second-in-command to the company’s CEO and is responsible for overseeing the day-to-day operations of the business, including product development, customer service, and financial management.

The COO is typically tasked with ensuring that the organization meets its operational and financial goals. They may also be responsible for developing and implementing operational strategies, managing resources, and setting operational budgets. Additionally, the COO may be responsible for overseeing the performance of various teams and departments.

The COO typically reports to the CEO and works closely with other senior executives to ensure the organization’s success. They may also be responsible for making key decisions regarding the company’s direction and future. The COO is usually the highest-ranking operations position within the organization, and depending on the size of the organization, may also be responsible for managing other executives who oversee the various operational functions.

The COO is usually an experienced and highly-skilled executive with a strong understanding of business operations and strategies. They must have a proven track record of leading teams and departments, as well as making sound decisions that benefit the organization. It is also important that the COO have excellent communication and interpersonal skills.

At the next level down, there are typically executives responsible for individual functional areas such as finance, human resources, and sales. These executives are typically responsible for managing the day-to-day operations of their respective departments and ensuring that the organization is meeting its operational goals.

In addition to the COO and the executive management team, there are also mid-level managers responsible for overseeing the various operational functions within the organization. These managers typically report to the executive team and are responsible for managing the performance of their respective teams.

No matter the size of the organization, the highest position in operations is typically the COO. The COO is responsible for overseeing the organization’s day-to-day operations, managing resources, and setting operational budgets. They must have a strong understanding of business operations and strategies, as well as excellent communication and interpersonal skills. In addition, they must have a proven track record of leading teams and departments and making sound decisions that benefit the organization.

What is higher than VP of operations?

The Vice President of Operations (VP of operations) is a senior executive who is responsible for managing and overseeing the day-to-day operations of a company. The VP of operations is often the second-in-command at a company, and typically reports directly to the CEO or president. But is VP of operations higher than other executive positions?

The short answer is no, the VP of operations is typically not higher than other executive positions. The VP of operations is usually the same level of responsibility as the Chief Operating Officer (COO), and both typically report to the CEO or president. Other executive positions may have more power or responsibility than the VP of operations, such as the Chief Financial Officer (CFO) or the Chief Executive Officer (CEO).

Though the VP of operations and COO are typically seen as the same level of responsibility, there are some key differences between the two positions. For example, the VP of operations usually has more direct control over the day-to-day operations of the company, while the COO is often responsible for more of the strategic direction of the company. The VP of operations also typically reports to the president or CEO, while the COO typically reports to the CEO.

Additionally, the VP of operations usually has less career development opportunities than the COO. VPs of operations typically remain in their position until retirement, while some COOs may have the opportunity to move into the role of CEO. This is because the VP of operations is often focused on the day-to-day operations of the company, while the COO is typically responsible for more of the strategic direction of the company.

The VP of operations is an important role in any company, and can often be the difference between success and failure. However, it is important to note that there are other executive positions that may be higher than the VP of operations, and may have more power or responsibility. It is important to understand the differences between the VP of operations and other executive positions, as well as the career development opportunities associated with each position.

What are the 4 order of operations?

The order of operations is an essential concept in mathematics and a key step in solving mathematical equations. It’s also known as the “PEMDAS” rule, an acronym for Parentheses, Exponents, Multiplication & Division, and Addition & Subtraction. Understanding the order of operations is important to help you arrive at the right answer.

Parentheses: The first step in the order of operations is to evaluate any parentheses first. This means that any expression within parentheses must be evaluated before any other operation can take place.

Exponents: The next step is to evaluate any exponents. An exponent is the number of times the base number is multiplied by itself. For example, in the expression 23, the base number is 2 and the exponent is 3, so 23 is equal to 8.

Multiplication & Division: After evaluating any parentheses and exponents, the next step is to evaluate any multiplication and division in the expression. This must be done from left to right, so if both multiplication and division are present, start with the multiplication on the left and then move to the right and evaluate any division.

Addition & Subtraction: The last step in the order of operations is to evaluate any addition and subtraction. Again, this must be done from left to right.

It is important to remember the order of operations when solving equations. It is also important to use parentheses to group operations, so that equations are read in the way they are intended. For example, if you have an equation 3 + 4 x 5, the answer would be 35 if you evaluated the multiplication first, and 23 if you evaluated the addition first. By using parentheses, you can make sure the equation is read in the way you intend: (3 + 4) x 5 = 23.

The order of operations is a fundamental concept in mathematics and understanding it is the key to solving equations accurately. By following the 4 steps outlined above, you can make sure that your equations are evaluated in the correct order and that you arrive at the correct answer.

Who is higher GM or VP?

When it comes to the corporate hierarchy, the question of who is higher – a General Manager (GM) or a Vice President (VP) – can be a bit of a grey area. It’s important to understand the different roles and responsibilities of each position in order to determine who is higher.

General Managers are responsible for the day-to-day operations of a division of a company or stand-alone branch. They are responsible for budgeting resources for marketing, supplies, equipment, and hiring. Because of their high level of responsibility, complex duties, and the need for extensive relevant experience, GMs earn more than entry-level employees.

Vice Presidents are members of upper management, and typically have more authority than general managers. They often work with the general managers of divisions within the company to ensure that the overall goals and objectives of the company are being met. Vice presidents may also be involved in the decision-making process for higher-level matters, such as strategy, acquisitions, and personnel.

So, the answer to the question – Is GM higher than VP? – is no. Generally, a general manager will report to upper management, which in turn sets the GM’s goals and targets. Vice presidents, on the other hand, are members of upper management and typically have more authority than general managers.

That said, there are exceptions to this general rule. Depending on the company, the structure of the management hierarchy may differ, and a general manager may have more authority than a vice president. The key to determining who is higher in such cases is to look at the individual roles and responsibilities of each position.

It’s also important to note that, while the GM and VP roles may be distinct in terms of their responsibilities, they often work together in order to achieve the overall objectives of the company. GMs collaborate with higher-level managers and executives and with the employees that they supervise. Meanwhile, VPs work with the GMs of divisions within the company to ensure that the overall goals of the company are being met.

In conclusion, although companies can structure their management hierarchy in a variety of ways, a general manager is not higher than a VP. The individual roles and responsibilities of each position determine who is higher in any given situation.

What are the three levels of operations?

Operations management is the organization of the processes and resources of an organization. It encompasses the planning, organizing, leading, and controlling of the resources necessary for production and delivery of goods and services. It can be categorized into three specific levels: strategic/top level/longterm management, tactical/functional/medium term/middle level management, and operational/short-term management.

What is Strategic Management? Strategic management is high-level management of the organization. It generally encompasses long-term decisions. Different managers manage their enterprise at different level. Management is bound together in hierarchy of relationships. There are three levels of management in the hierarchy of an organization. These are:

Top Management

Top management consists of the senior-most executives of the organisation. They are responsible for making strategic decisions, such as setting the organisation’s overall mission and objectives. They are also responsible for setting the organisation’s overall budget, setting goals and policies, and making decisions on which markets to enter.

Middle Management

Middle management is responsible for carrying out the decisions made by the top management. They are responsible for the implementation of plans and policies. They are also responsible for the day-to-day operations of the organization, such as overseeing the activities of the staff, monitoring performance, and providing guidance and direction.

Operational Management

Operational management is responsible for the actual execution of the plans and policies. They are responsible for the day-to-day activities of the organization, such as production, scheduling, inventory control, quality control, customer service, and so on. They are also responsible for ensuring that the organization meets its goals and objectives.

The difference between the three levels of strategy in an organization is the level at which they operate in a business. The three levels are corporate level strategy, business level strategy, and functional level strategy. Corporate level strategy is concerned with the overall direction of the organization and is the highest level of strategy. Business level strategy is concerned with the individual businesses of the organization and is the middle level of strategy. Functional level strategy is concerned with the individual functions of the organization and is the lowest level of strategy.

By understanding the three levels of operations management, organizations can better plan and manage their operations. This can help them to better meet their goals and objectives, as well as to optimize their resources and processes. It can also help them to identify areas of improvement and to better understand their customers’ needs and wants. With the right strategy in place, organizations can improve their efficiency, productivity, and customer satisfaction.

Who is above Director of Operations?

When it comes to the corporate hierarchy, the director of operations typically reports to the chief executive officer (CEO). The director of operations is an executive-level position, working with senior-level management and C-suite positions.

What is an Operations Director? An operations director is a senior-level executive responsible for managing the day-to-day operations of a business or organization. This role oversees all operational activities, such as managing staff, ensuring compliance with regulations, and maintaining quality standards. Operations directors can be found in private, public, non-profit, or government sectors and job titles may differ depending on the industry.

An operations director is an executive who is in charge of managing the day-to-day operations of a company. This may include a wide range of tasks such as improving efficiency, setting budgets, and implementing employee policies. As an executive-level position, the director of operations is responsible for developing and executing strategies to maximize organizational efficiency and effectiveness.

What are the Responsibilities of an Operations Director? An operations director is responsible for managing the overall operations of a business or organization. This includes overseeing staff, ensuring compliance with regulations, and maintaining quality standards. They are also responsible for developing and implementing operational strategies to maximize organizational efficiency and effectiveness. Additionally, operations directors are responsible for monitoring financial performance and creating budgets.

What Qualifications are Needed to Become an Operations Director? To become an operations director, you should have a Bachelor’s degree in business administration, finance, or a related field. Previous experience in management or operations is also beneficial. Additionally, strong leadership, communication, and organizational skills are necessary for success in this role.

What is the Salary of an Operations Director? The average salary for an operations director is $90,000 per year. This can vary depending on experience, qualifications, and the size and industry of the organization.

In conclusion, the director of operations is a senior-level executive responsible for managing the day-to-day operations of a business or organization. They report to the chief executive officer (CEO) and are responsible for overseeing all operational activities, developing and implementing strategies to maximize organizational efficiency and effectiveness, and monitoring financial performance. To become an operations director, you should have a Bachelor’s degree in business administration, finance, or a related field, as well as previous experience in management or operations. The average salary for an operations director is $90,000 per year.

Business

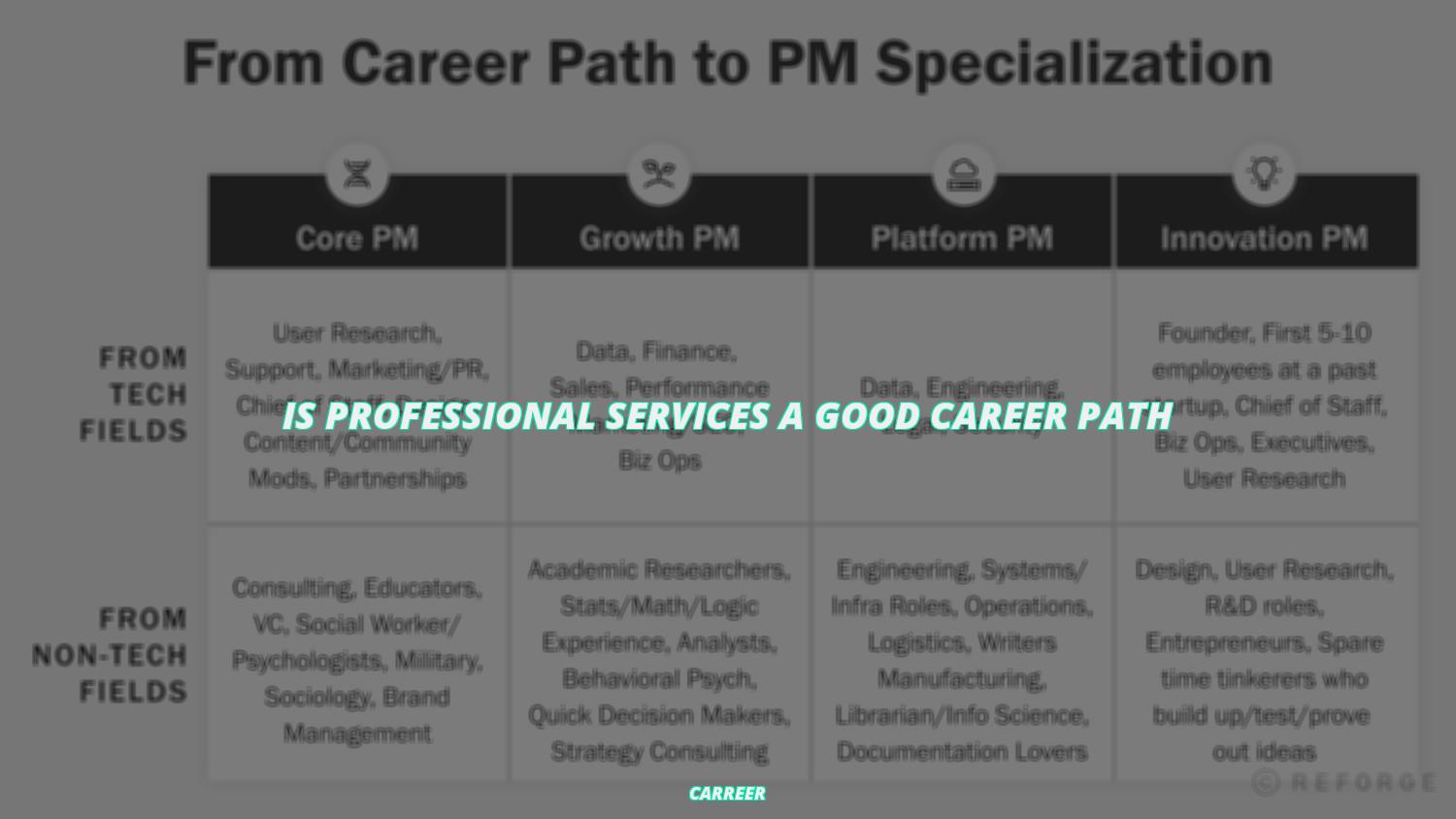

Is professional services a good career path

Professional services is a broad and ever-growing industry that encompasses a range of different disciplines and specializations. It is an industry where creativity, hard work and enthusiasm are rewarded in terms of job prospects and career advancement opportunities. Professional services firms provide a wide range of services such as consulting, accounting, legal advice, financial services, engineering and IT services. This makes them attractive employers relative to many other sectors of the economy where layoffs or downsizing are common occurrences.

The demand for professional services is increasing, and so is the competition. With more and more people wishing to pursue a career in this field, it’s important to understand what it takes to be successful. In order to succeed in the professional services industry, you must have a combination of skills and expertise. These include analytical, communication and problem-solving skills, as well as the ability to develop relationships and be detail-oriented. You also need to have a strong work ethic and be willing to put in long hours.

The Big Four professional services firms – Deloitte, Ernst & Young, KPMG and PwC – are the leaders in the industry. They offer a wide range of services to their clients and provide a strong foundation for career growth. Other industries that fall under the professional services umbrella include engineering, healthcare, architecture and IT services.

To determine if professional services is a good career path in 2023, it’s important to consider the current job market. The demand for professional services has been growing steadily for the past few years, and this trend is expected to continue. As the economy continues to grow and more businesses begin to focus on their digital strategies, the demand for these specialized services will increase.

For those looking to pursue a career in professional services, the future looks bright. With the right skills and experience, you can make a successful career out of it. However, it is important to keep in mind that competition is high and only the best will succeed. To ensure success, having a strong work ethic, problem-solving skills, communication skills and the ability to develop relationships are essential.

Is professional services a good career path

If you’re looking for a career that offers a steady stream of opportunities, professional services may be the perfect fit. Professional and business services is a high-demand industry with plenty of opportunities for qualified job seekers. But is professional services a good career path in 2023?

To answer that question, it’s important to understand the unique advantages of a career in professional services. Professional services firms offer a wide variety of opportunities for job seekers. From accounting and consulting to legal services and human resources, professional services firms offer a diverse set of skills for those interested in a career in the industry.

In addition, the professional services industry is relatively recession-proof. This makes them attractive employers relative to many other sectors of the economy where layoffs or downsizing are common occurrences.

If you’re considering a career in professional services, there are certain skills you’ll need to be successful. In addition to technical skills related to the specific job you’re seeking, strong soft skills are also essential. Effective communication, teamwork, problem-solving, analytical skills, and proactive thinking are necessary to secure a job in professional service firms.

Another advantage of a career in professional services is the potential for career growth. The industry is constantly evolving, and those who are willing to stay ahead of the curve can find great opportunities for advancement. As firms expand and explore new markets, they often need people with the skills and ambition to take on new roles and responsibilities.

Finally, a career in professional services can be personally rewarding. Working with clients to solve their problems and help them reach their goals can be a fulfilling experience. Plus, the industry offers a wide range of salaries and benefits, making it an attractive option for job seekers.

So is professional services a good career path in 2023? The answer is yes. With the right skills and a willingness to stay ahead of the curve, job seekers can find plenty of opportunities for growth in the professional services industry. If you’re looking for a career with great potential, professional services may be the perfect fit.

What industries fall into professional services?

Professional services are occupations in the service sector that require special training in certain arts or sciences. Examples of professional services include architects, accountants, engineers, doctors, and lawyers, which all require practitioners to hold professional degrees or licenses and possess specific skills.

But what other industries fall into the professional services category?

Although professional services is a broad term, it encompasses many industries. Think of professional services as anything that a business owner may need to outsource in order to have more time to focus on their priorities and business operations.

Examples of occupations in professional services include project management, consulting, marketing, public relations, human resources, information technology, advertising, accounting, financial planning, legal services, engineering, and architecture.

In addition to these occupations, professional services can also include niche services such as search engine optimization (SEO), web design and development, digital marketing, social media management, and website maintenance.

In law, barristers typically organize themselves into chambers, and professional services are provided jointly by members of a chamber. This is also the case in other professions such as accountancy and engineering, where the professional service is provided jointly by a company, partnership, or limited liability partnership.

In some cases, a professional services firm may also offer other services such as tax advice, financial advice, and insurance services. This is particularly the case for accounting firms, which are often involved in providing a range of services to their clients.

When it comes to providing professional services, it is important to ensure that you are working with a professional who is qualified and experienced in their field. This is why it is important to conduct research and ask for references before engaging with a professional services firm or individual.

It is also important to ensure that you are aware of any potential conflicts of interest and that the services you receive are tailored to meet your specific needs. It is also important to ensure that the professional services you receive are compliant with any relevant laws or regulations.

In summary, professional services encompass a wide range of industries, from traditional occupations such as accountancy, engineering, and law to niche services such as SEO and web design. When engaging with a professional services firm or individual, it is important to ensure that they are qualified and experienced in their field and that their services are tailored to meet your specific needs.

What comes under professional services?

Professional services refer to a specific set of occupations that require special training in the arts or sciences. These services are typically provided by sole proprietors, partnerships or corporations, and the person providing the service can often be described as a consultant. Examples of professional services include accountants, lawyers, doctors, engineers, architects, and financial advisors.

Accountants are responsible for providing financial advice and managing the finances of their clients. They must possess a thorough knowledge of taxation laws, investment strategies and financial management procedures. Accountants must also have a strong understanding of accounting principles and be skilled in using accounting software.

Lawyers are responsible for providing legal advice to their clients. They must possess a thorough knowledge of the law and be skilled in both written and verbal communication. Lawyers typically specialize in a particular area of law and must be able to interpret and apply the law in a variety of contexts.

Doctors are responsible for providing medical care to their patients. They must possess a thorough knowledge of medical procedures, treatments and medications as well as a strong understanding of human anatomy and physiology. Doctors must also have excellent communication and interpersonal skills in order to effectively diagnose and treat their patients.

Engineers are responsible for designing and constructing a variety of structures and systems. They must possess a thorough knowledge of physics, mathematics and engineering principles as well as a strong understanding of the materials and techniques used in their field. Engineers must also be able to use a variety of software and technology to design, construct and test their projects.

Architects are responsible for designing buildings and other structures. They must possess a thorough knowledge of engineering principles, building codes and design techniques as well as a strong understanding of the materials and techniques used in their field. Architects must also be able to use a variety of software and technology to design and construct their projects.

Financial advisors are responsible for providing financial advice and guidance to their clients. They must possess a thorough knowledge of financial markets, investment strategies and taxation laws. Financial advisors must also be skilled in using financial software and have excellent communication and interpersonal skills in order to effectively advise their clients.

Professional services are often provided on a consultancy basis by independent contractors. These individuals must possess a thorough knowledge of their field as well as a strong understanding of the laws and regulations that govern their industry. Professional services are also frequently infrequent in nature, and the expertise required to provide them is attained only after rigorous training and certification.

In conclusion, professional services refer to a specific set of occupations that require special training in the arts or sciences. These services can be provided by sole proprietors, partnerships or corporations, and the person providing the service can often be described as a consultant. Examples of professional services include accountants, lawyers, doctors, engineers, architects, and financial advisors.

What is the future of professional services?

The future of professional services is an ever-evolving landscape, with technology and new ways of organizing and delivering services continuing to challenge the traditional ways that professionals have traditionally operated. Richard Susskind, one of the leading authorities on the “future of professional services”, has even said that technology will eventually displace traditional professional services, leading to the dismantling of the professions.

This disruption is already underway in the form of digital talent platforms, which are set to revolutionize business and benefit up to 540 million individuals by 2025, according to a recent study from McKinsey. These platforms are offering opportunities for businesses to access the skills of professionals from all over the world, creating a global workforce that can be accessed and utilized on demand.

At the same time, the very nature of the “practical expertise” that professionals deliver is being challenged. Services such as legal advice, engineering design, and financial advice are increasingly being automated, with advances in artificial intelligence and machine learning making it possible for businesses to access these services without the need for a traditional professional.

These changes are likely to have a significant impact on the professional services sector, with some predicting that the traditional roles of professionals will be replaced by technology-enabled services. This could lead to a shift in the balance of power between businesses and professionals, as businesses take advantage of new technologies to more efficiently access the services of professionals.

At the same time, there are also opportunities for professionals to leverage technology to improve their services and increase their value to their customers. For example, professionals can use analytics and data to provide more personalized and tailored services to their clients, as well as using automation to improve their efficiency and effectiveness.

Ultimately, the future of professional services is uncertain, and it is likely that the sector will continue to evolve and change as technology develops. However, businesses should take steps to ensure they are prepared for this disruption and make the most of the opportunities that technology can offer. For example, by joining Consultants 500, a niche job board with a 100% professional services focus, businesses can access the best talent in the sector and ensure they are well placed to take advantage of the new services and technologies that are revolutionizing the way professional services are delivered.

What are the Big Four professional services?

The Big Four professional services firms – Deloitte, EY, KPMG, and PwC – are the largest and most influential networks in the world. While they may be well-known to many, they deserve a closer look. What do they do? How do you get a job there? What is it like to work for them? What sets them apart from McKinsey, BCG, and Bain?

These firms offer a wide range of services, from auditing and accounting, to advisory and consulting, to tax, risk and legal advice. All of the Big Four firms have their roots in the accounting industry, and are often referred to as “Big 4 accounting firms”.

Auditing and Accounting

Auditing and accounting services are primarily focused on financial reporting, and involve assessing the accuracy of a company’s financial statements. This is a critical task for any business, as it helps ensure that the company’s financial information is reliable and up-to-date. The Big Four firms provide a range of auditing and accounting services to organizations, including assurance services, financial statement preparation, and business consulting.

Advisory and Consulting

The Big Four also offer a range of advisory and consulting services to help organizations optimize their operations and strategies. These services include strategy and operations consulting, which focuses on helping organizations identify and address the most pressing challenges they face. They also provide IT consulting, which helps organizations better understand their technology needs and develop solutions that meet those needs.

Tax, Risk and Legal Advice

The Big Four firms also provide tax, risk and legal advice to organizations. This includes helping organizations understand their tax obligations and develop strategies to reduce their tax burden. They also provide risk management advice, helping organizations identify and manage risks associated with their operations. Finally, they offer legal advice to organizations, helping them understand the legal implications of their business decisions.

A Career at The Big Four

Working at one of the Big Four firms can be an incredibly rewarding experience. The firms offer a wide range of opportunities and provide employees with unparalleled access to resources and training. Employees are also given the opportunity to work on some of the most interesting and complex projects in the world.

For those looking to join one of the Big Four firms, there is a rigorous recruitment process. Applicants must have a strong academic background, excellent communication and interpersonal skills, and the ability to think strategically. The firms also look for applicants who have the ability to work in a fast-paced and dynamic environment.

The Big Four firms are some of the most influential organizations in the world. They offer a range of services, including auditing and accounting, advisory and consulting, and tax, risk and legal advice. They also provide employees with a unique opportunity to work on some of the most challenging and rewarding projects in the world.

What is the most stable industry to work in?

Finding a job in a stable industry is key for those looking for security and long-term employment. Fortunately, there are many sectors that are growing and where workers tend to stay with the same employer for a long time.

To get a sense of overall job security for different industry sectors, the Bureau of Labor Statistics analyzed the median job tenure as of 2018 and the percent growth or decline in the number of people employed in each industry between March 2014 and March 2019.

The industries with the highest scores for job security were Information Technology, Healthcare, Financial Services, Energy and Utilities, and Manufacturing.

Information Technology is one of the fastest growing sectors, with employment increasing by 16.3 percent between 2014 and 2019. Those employed in the IT sector also tend to stay in their jobs longer than other industries, with a median job tenure of 5.2 years in 2018.

Healthcare is another sector that is growing rapidly, with employment increasing by 13.6 percent between 2014 and 2019. Healthcare workers also tend to stay in their jobs longer, with a median job tenure of 5.2 years in 2018.

Financial Services is a sector that is growing quickly, with employment increasing by 8.8 percent between 2014 and 2019. Financial Services workers also tend to stay in their jobs longer, with a median job tenure of 5.9 years in 2018.

Energy and Utilities is another sector that is growing quickly, with employment increasing by 8.4 percent between 2014 and 2019. Energy and Utilities workers also tend to stay in their jobs longer, with a median job tenure of 5.8 years in 2018.

Manufacturing is a sector that is growing slowly, with employment increasing by just 1.3 percent between 2014 and 2019. However, Manufacturing workers tend to stay in their jobs longer, with a median job tenure of 6.3 years in 2018.

Overall, industries that have high employment growth and where employees tend to stay in the industry for a longer period of time are likely to be better for those seeking job security. In particular, Information Technology, Healthcare, Financial Services, Energy and Utilities, and Manufacturing are some of the most stable industries to work in.

If you are looking for a job in a secure and stable industry, these five sectors are a great place to start. With high employment growth and long job tenures, these sectors are likely to provide the security and stability you are looking for.

To ensure you are getting the most out of your job search, it is important to research the different industries and employers before applying. For more information on job security in different industries, check out the Bureau of Labor Statistics’ latest data.

Business

What are the 3 levels of operations management?

Operations management is one of the most essential components of any organization. It helps to drive the company’s success by ensuring that all operations run smoothly and efficiently. It is important for an organization to have a clear understanding of the three levels of operations management in order to effectively manage its operations.

At the highest level of operations management is the top management, which consists of the senior-most executives of the organization. They are responsible for making long-term decisions and setting the overall direction of the organization. They also need to ensure that the organization is meeting its goals and objectives, and that it is taking steps to ensure its long-term success.

Middle management is the next level of operations management. This level includes the middle-level managers who are responsible for implementing the strategies set out by the top management. They also need to ensure that the daily operations of the organization are running smoothly and that any problems are addressed in a timely manner.

Finally, the third and lowest level of operations management is the operational or supervisory level. This level is responsible for the day-to-day operations of the organization. They are responsible for ensuring that the organization is running efficiently and that all tasks are completed on time. They are also responsible for ensuring that any issues are addressed quickly and effectively.

It is important for an organization to understand the three levels of operations management in order to ensure that all operations run smoothly and efficiently. By understanding the different levels, an organization can ensure that it is meeting its goals and objectives, and that it is taking steps to ensure its long-term success.

What are the 3 levels of operations management?

Operations management is an important element of business management, and it is essential to understand the various levels of operations management and their roles. The three levels of operations management are top, middle and operational.

Top Level Management consists of the senior-most executives of the organization. They are responsible for setting the overall goals and objectives of the organization and formulating strategies for achieving these goals. They are also responsible for setting the organization’s policies and procedures and developing the organization’s overall vision. Top level managers are responsible for the long-term decisions made by the organization, such as the overall direction of the organization, resource allocation and the implementation of new technologies.

Middle Level Management consists of managers who are responsible for managing and supervising the implementation of the strategies set by the top level management. They are responsible for the day-to-day operations of the organization and for ensuring that the organization is achieving its objectives. They are also responsible for managing the organization’s resources and personnel and for ensuring that all employees are properly motivated and trained.

Operational Level Management consists of employees who are responsible for carrying out the day-to-day operations of the organization. They are responsible for managing the organization’s resources, such as equipment, supplies and personnel, and for ensuring that the organization is meeting its operational objectives. They are also responsible for the implementation of new technologies and for ensuring that the organization is following the policies and procedures set by the top level management.

Operations management is an essential part of any business and understanding the different levels of operations management is essential in order to ensure that the organization is operating efficiently and effectively. The top level management is responsible for setting the overall direction of the organization, while the middle level management is responsible for the day-to-day operations and the operational level management is responsible for carrying out the operations of the organization. By understanding the roles and responsibilities of each of the levels of operations management, organizations can be better equipped to meet their goals and objectives.

What are the 3 core functions of an organization?

Organizations exist for the purpose of achieving a defined outcome, and these outcomes are typically measured by units of success. To reach these goals, organizations must employ core business functions. These are the main activities of a company and are integral to the success of the organization.

The three major functional areas of operations all rely on each other, and organizations must ensure that all of these areas are working together in order to be successful. The three major functions are strategic planning, operations management, and marketing.

Strategic Planning is the process of setting an organization’s long-term goals and objectives. It involves researching the market and analyzing the organization’s capabilities and resources in order to determine what direction the company should take. Strategic planning also includes analyzing risks and opportunities, as well as creating a plan to reach the desired goals.

Operations Management is the process of planning, organizing, and controlling the production of goods or services. It involves ensuring that the organization’s resources are used efficiently and effectively. This includes managing the supply chain, production, and distribution of goods or services.

Marketing is the process of promoting and selling products or services. It involves researching customer needs and wants, designing a product or service to meet those needs, and then advertising and promoting it in order to increase sales.

These three core functions of an organization must all work together in order to achieve success. Strategic planning informs operations management, which in turn informs marketing. Operations management must be able to provide the necessary resources for marketing to be successful. Finally, marketing must be able to generate enough sales to support the operations management and strategic planning of the organization.

Organizations that have a well-defined strategy, efficient operations management, and effective marketing will be more likely to succeed. By understanding and utilizing the three core functions of an organization, organizations can maximize their value and reach their desired goals.

What are the 3 important qualities in an operation role?

Operations roles require a diverse set of skills and qualities in order to be successful. In order to lead an operations team effectively, an individual must possess a unique combination of qualities, including strong motivational and decision-making skills, as well as the ability to think strategically and creatively.

Motivational Skills: Motivational skills are essential for any successful operations role. An effective leader needs to be able to inspire, motivate and engage their team members in order to reach their goals. This requires the ability to communicate effectively, to recognize individual strengths and to foster collaboration. A leader must also be able to build trust, create a positive working environment, and recognize and reward individual performance.

Decision-Making Skills: Decision-making is an important part of any operations role. A successful leader needs to be able to make quick, informed decisions in a variety of situations. They need to be able to assess risk, analyze data, and develop solutions to problems. They also need to be able to communicate their decisions clearly and effectively to the rest of their team.

Strategic Thinking: A successful operations leader needs to be able to think strategically. This involves analyzing data and trends, anticipating future needs, and developing plans to meet those needs. Strategic thinking also requires the ability to analyze the current market and develop strategies to stay ahead of the competition.

These three qualities are essential for any successful operations leader. Without them, it is difficult to ensure that the team is able to reach its goals. In order to be successful in an operations role, an individual must possess a unique combination of qualities, including strong motivational and decision-making skills, as well as the ability to think strategically and creatively.

What are the 3 basics of the organizational structure?

Organizational structure is an essential element of any organization, as it outlines the chain of command and workflow, as well as how information flows between the different levels of the company. It is also the basis for decision-making and communication within the organization, which is why it is important to understand the basics. The three basics of organizational structure are work design, departmentalization, and hierarchy.

Work Design: The work design outlines the roles, responsibilities, and tasks of each job within the organization. It is based on the skills and experience of each employee, and ensures that the right person is in the right job, and that each employee is able to perform to the best of their abilities. It also helps to create a sense of team spirit, as everyone knows that their role is integral to the success of the organization.

Departmentalization: Once the work design has been established, the next step is to group together similar tasks and roles, and to create departments. This is known as departmentalization, and it helps to ensure that tasks are completed efficiently and effectively. It also allows for better communication and collaboration between different departments, which is essential for the smooth running of any organization.

Hierarchy: The hierarchy is the system of ranking within the organization, and it is based on the roles and responsibilities of each employee. This helps to create a sense of accountability, as each employee knows where they stand in the company and who they are responsible to. It also helps to create a sense of order, as those with the highest rank have the authority to make decisions and give directions to those below them.

These three basics of organizational structure are essential for any organization to run smoothly and efficiently. They help to create a chain of command, to ensure that tasks are completed efficiently, and to create a sense of accountability and order within the organization. Understanding these basics is key to creating a successful organizational structure.

What are 3 organizational strategies?

Organizational strategies are essential for any business, as they provide a framework for the direction of the organization, and are used to identify and achieve the business goals. There are three main levels of organizational strategies: corporate level, business level, and functional level.

Corporate Level Strategy is the highest level of strategy, and is used to set overall business goals and objectives. The main purpose of this strategy is to ensure that the organization is heading in the right direction and is focused on achieving its goals. It also involves making decisions regarding the direction of the organization, the allocation of resources, and the overall strategy for the business.

Business Level Strategy is the second level of strategy and is used to ensure that the organization is achieving its corporate level goals. It involves making decisions regarding the organization’s activities, such as marketing, sales, production, finance, and infrastructure. Business level strategies also involve setting goals for each of these activities and ensuring that they are met.

Functional Level Strategy is the third level of strategy and is used to ensure that the organization is achieving its business level goals. This includes making decisions regarding the use of resources and capabilities to support business activities. This includes decisions regarding the use of capital, labor, and inventory. Functional level strategies also involve setting goals for each of these activities and ensuring that they are met.

Organizational strategies are important for any business, as they provide a framework for the direction of the organization, and are used to identify and achieve the business goals. By having a clear and well-defined organizational strategy, businesses can ensure that they are heading in the right direction and are focused on achieving their goals. Additionally, having an organizational strategy in place can help businesses to make more informed decisions and better utilize their resources, leading to increased efficiency and effectiveness.

What are the 3 organizational theories?

Organizational theory is an important field of study that helps us to understand how organizations interact with their environment and how their internal elements interact with each other. It is a broad field that encompasses various theories, each with their own unique approaches and perspectives. Here, we will explore the three most widely accepted organizational theories: Weber’s ideal of bureaucracy, modernization theory, and the Hawthorne study and contingency theory.

Weber’s Ideal of Bureaucracy is a theory developed by German sociologist Max Weber in the early 20th century. He argued that organizations can be well managed when they are structured in a hierarchical manner and when they are based on a set of rules and regulations. He also argued that organizations should be characterized by a clear division of labor and formalized lines of authority. This theory has been widely adopted by many organizations, as it provides a clear understanding of how an organization should be structured and managed.

Modernization Theory is a theory developed by American sociologist Talcott Parsons in the 1940s. It seeks to explain how organizations can adapt to changing environments and how they can remain competitive. This theory states that organizations should be able to use their resources efficiently and effectively in order to remain competitive. It also suggests that organizations should be aware of their external environment and be flexible in order to remain competitive.

The Hawthorne Study and Contingency Theory is a theory developed by American sociologist Elton Mayo in the 1930s. It suggests that organizations should be aware of their internal environment and be prepared to make changes in order to remain competitive. This theory also suggests that organizations should be aware of the external environment and be able to adapt to changing conditions in order to remain competitive.

Organizational theory is an important field of study that helps us to understand how organizations interact with their environment and how their internal elements interact with each other. It is important to understand the three main organizational theories, as they are widely accepted and provide a valuable insight into how organizations should be managed and structured. By understanding the theories of Weber, Parsons and Mayo, organizations can remain competitive and efficient by adapting to their environment and making changes when necessary.

-

Career2 years ago

Career2 years agoWhat is the lowest salary for a pharmacist?

-

Career2 years ago

Career2 years agoCustomer success manager career path

-

Career2 years ago

Career2 years agoWhat is the highest paying customer service?

-

Customer Service2 years ago

Customer Service2 years agoWhat is the highest paid customer service job?

-

Customer Service2 years ago

Customer Service2 years agoOnsumer services a good career path

-

Career2 years ago

Career2 years agoWhat are 3 important criteria for choosing a career?

-

Customer Service2 years ago

Customer Service2 years agoConsumer services jobs

-

Customer Service2 years ago

Customer Service2 years agoWhat are three careers in consumer services?