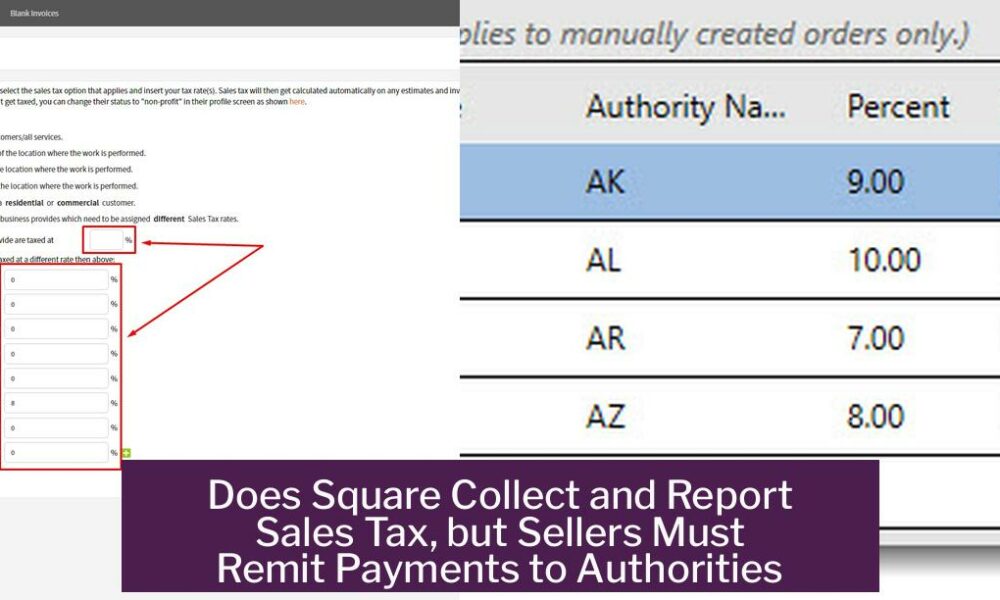

Does Square Automatically Pay Sales Tax? Square does not automatically pay sales tax on your behalf. It helps calculate and collect sales tax during transactions, but...

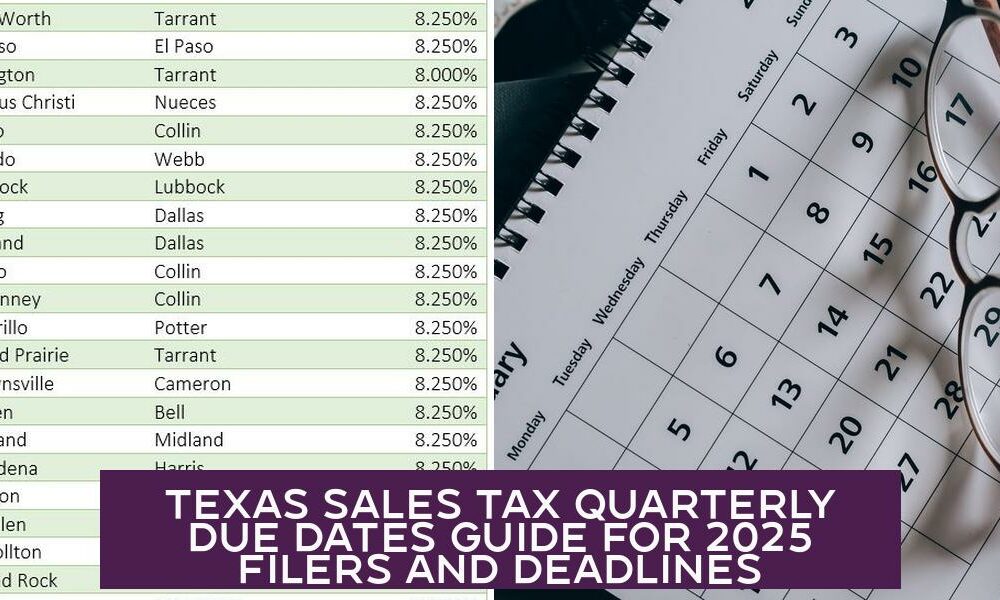

Texas Sales Tax Quarterly Due Dates Texas sales tax quarterly due dates occur four times a year, on April 20, July 20, October 20, and January...

What Is Square’s Processing Fee? Square’s processing fee is a percentage of the transaction amount plus a fixed cent amount depending on the type of transaction....

How to Add Credit Card Fee on Square Square does not allow merchants to directly add credit card fees through surcharging. Instead, the platform supports adding...

What Is a Resale Certificate in Texas? A resale certificate in Texas is a tax-exempt document that allows businesses to purchase taxable items without paying sales...

Understanding Taxable Purchases in Texas Taxable purchases in Texas refer to items bought, leased, or rented for personal or business use where sales or use tax...

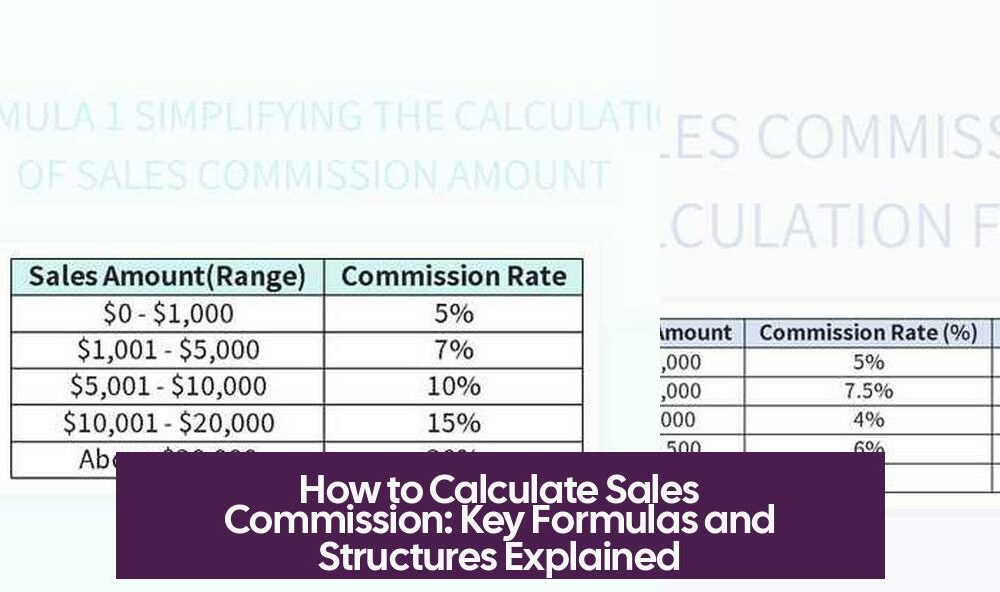

How to Find Sales Commission Sales commission is calculated by applying a commission rate to the sales revenue generated by a salesperson. This rate can vary...

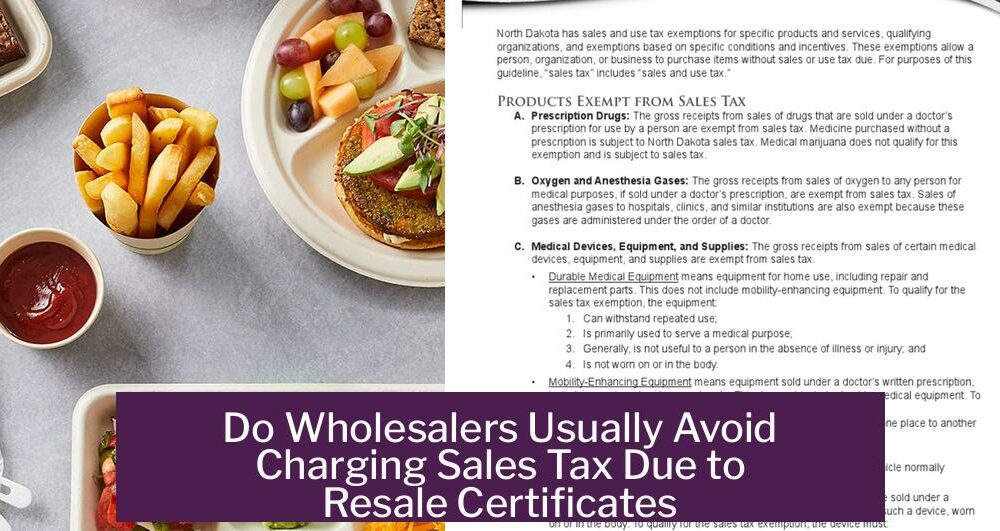

Do Wholesalers Pay Sales Tax? Wholesalers generally do not pay or charge sales tax because sales tax applies only at the point of sale to the...