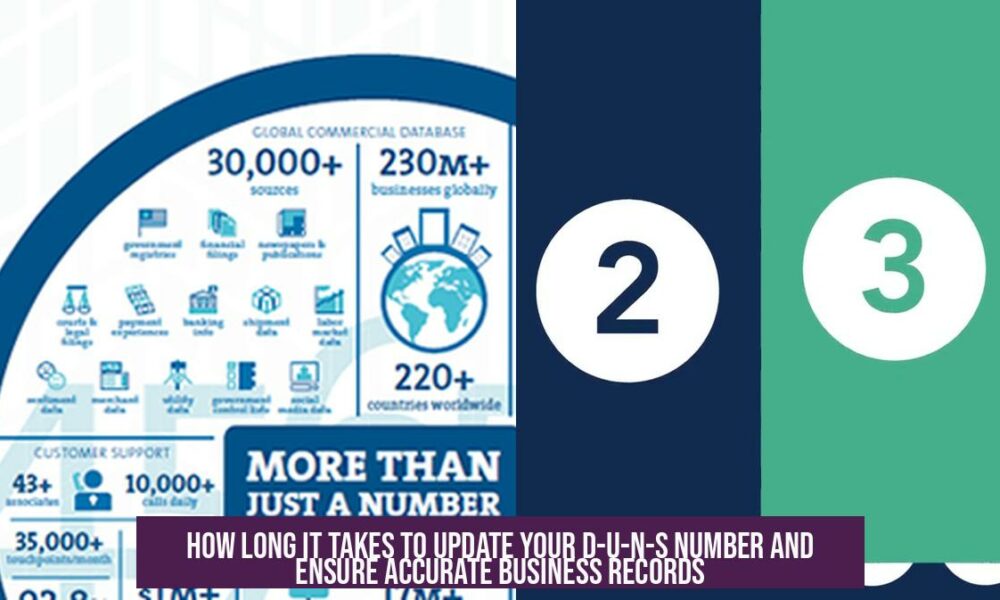

How Long It Takes to Update the D-U-N-S Number Updating a D-U-N-S (Data Universal Numbering System) number typically takes between 5 to 30 business days depending...

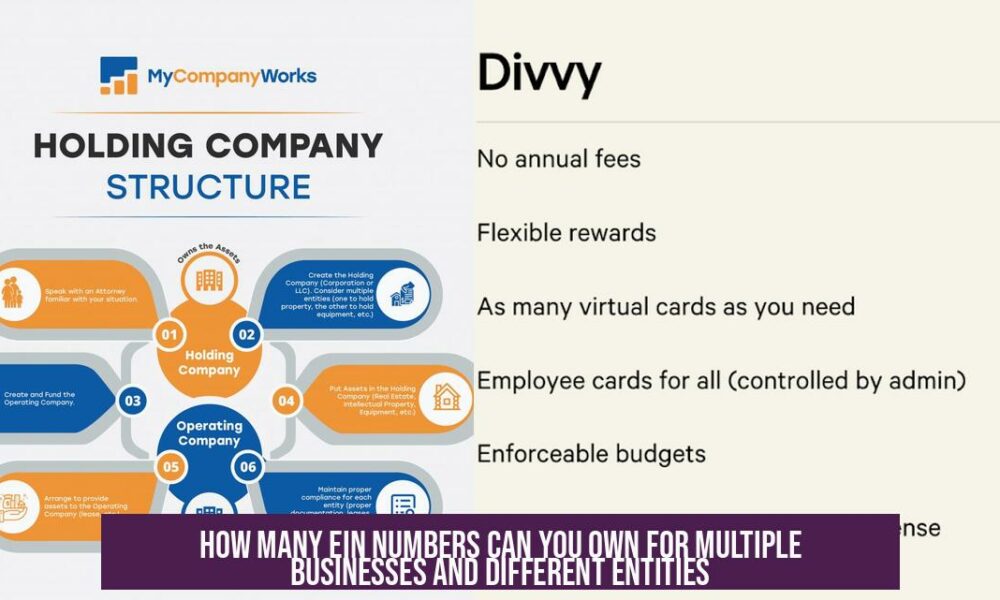

How Many EIN Numbers Can You Have? An individual or entity can have as many EINs as the number of business entities they operate, with the...

Is EIN Confidential? Your Employer Identification Number (EIN) is technically public information, but it requires careful handling to prevent misuse and fraud. While EINs appear in...

Can I Use an EIN for a Sole Proprietorship? Yes, a sole proprietorship can use an EIN (Employer Identification Number), but it is not always required....

Understanding the Difference Between FEIN and EIN The difference between FEIN and EIN is essentially nonexistent; both refer to the same federal tax identification number issued...

Understanding FinCEN Sole Proprietorship and CTR Filing Requirements The Financial Crimes Enforcement Network (FinCEN) clarifies the procedure for filing Currency Transaction Reports (CTR) involving sole proprietorships...

Can I Use My EIN Instead of SSN? Yes, you can use your Employer Identification Number (EIN) instead of your Social Security Number (SSN) for many...

How Do You Close a Sole Proprietorship? Closing a sole proprietorship involves multiple steps, including filing a final tax return, handling employees, paying taxes owed, reporting...

Do I Need a DUNS Number? A DUNS number is not legally required for every business. However, it plays an important role in building business credit...

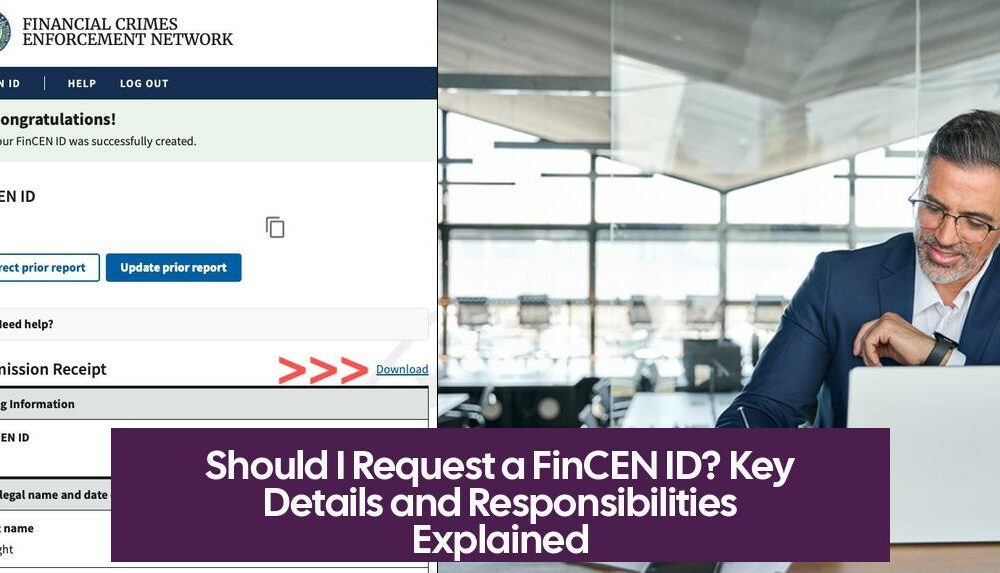

Do I Need to Request a FinCEN ID? A FinCEN ID is not mandatory but obtaining one benefits individuals or companies that regularly file Beneficial Ownership...