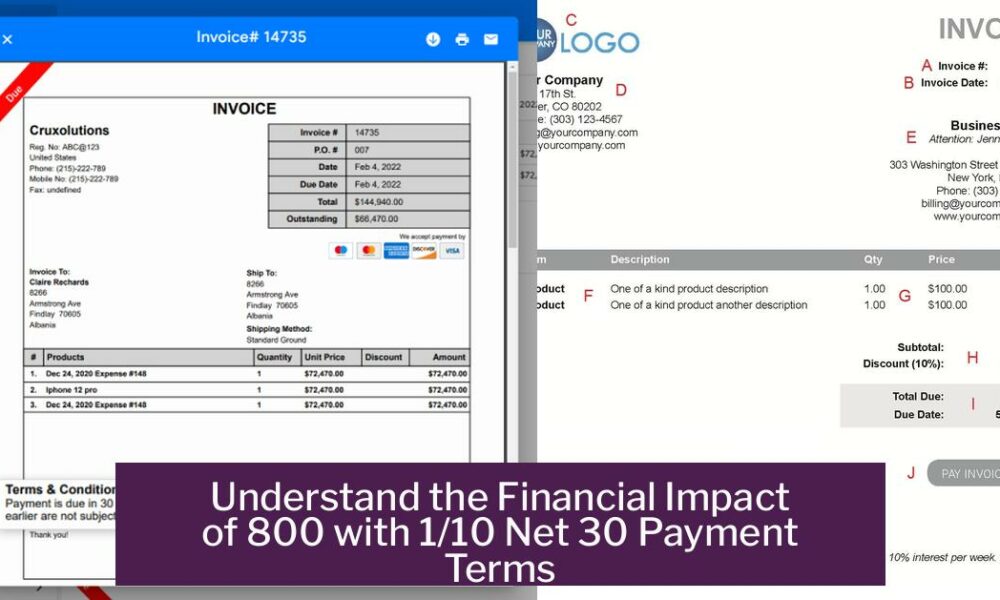

Understanding 800 with 1/10 Net 30 Payment Terms The term “800 with 1/10 net 30” means an $800 invoice where the buyer can receive a 1%...

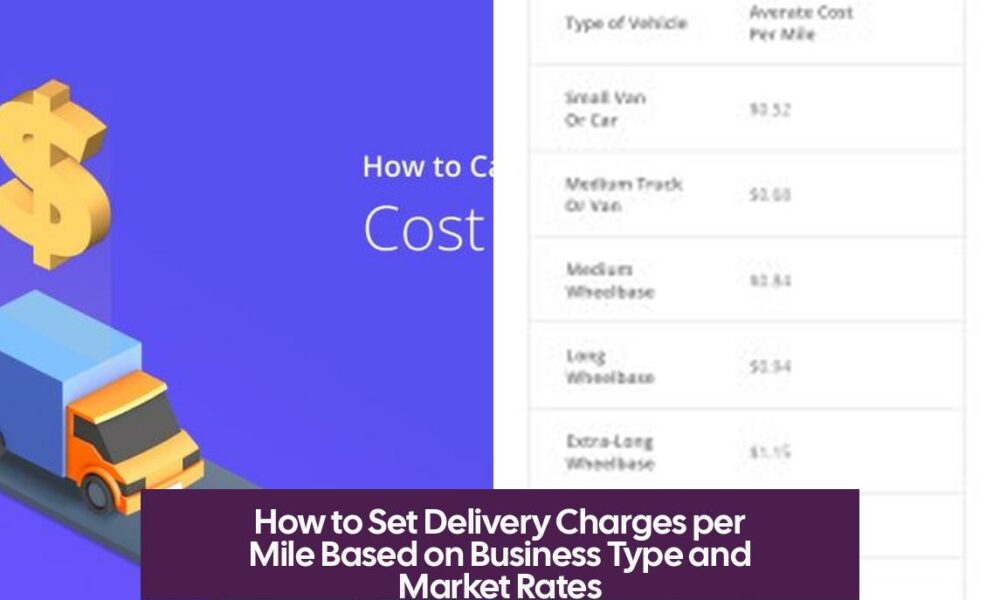

How Much to Charge Per Mile for Delivery The average cost to charge per mile for delivery ranges between $1.50 and $2.00 in the US, depending...

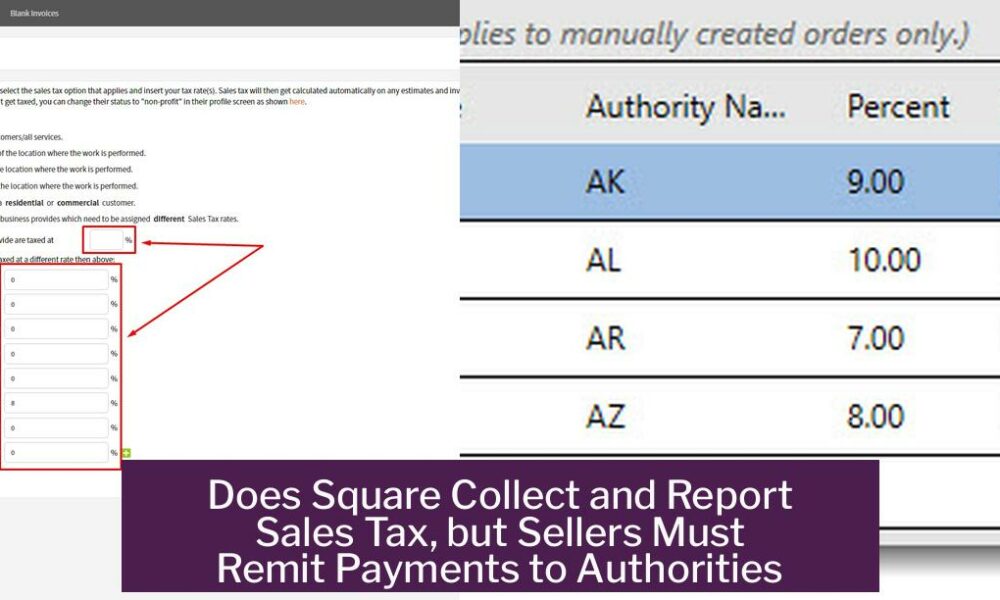

Does Square Automatically Pay Sales Tax? Square does not automatically pay sales tax on your behalf. It helps calculate and collect sales tax during transactions, but...

Understanding Google’s Changing Editorial Summary Google’s editorial summary is evolving to enhance content presentation and user experience. This summary is a concise description that accompanies search...

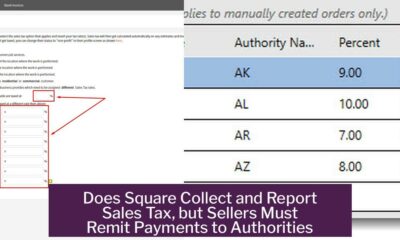

What Do You Send to Collections? When sending a debt to collections, you should send all relevant documents that prove the debt and show your efforts...

Understanding Hiring of Family Members Hiring family members is legal in many businesses, but it requires careful management to avoid conflicts and legal issues. It is...

How Do You Become a Personal Shopper? A personal shopper buys items for clients who lack the time or ability to shop themselves, specializing in various...

How Do I Get Bonded for My Business? Getting bonded for a business involves obtaining a surety bond that protects customers from possible financial loss caused...

How Much Does It Cost to Rent a Daycare Center? The cost to rent a daycare center varies widely, typically ranging from $1,000 to over $5,000...

D2D Meaning in Business D2D in business refers to “Door-to-Door” marketing, a direct sales strategy where salespeople visit potential customers at their homes or workplaces to...